The war in Ukraine was a major inflection point for global capital markets, adding pressure to already strained energy and food markets.

According to the Bank for International Settlements, global liquidity in 2021 reached an unprecedented $175 trillion, twice global GDP. That figure set the tone for the year in investment banking, as cash-rich companies powered record deal making worldwide.

The macro scenario imposed different impacts on the world’s regions, however; so while most capital markets recorded positive figures, the depth of their rebounds varied.

In the US, a combination of zero interest rates and supportive central bank policy pushed equity, M&A and initial public offering (IPO) activities to record levels, while debt offerings took a tumble. Europe saw similar trends but with more stability on the bond side. Lagging the rest of the world on the equity side, Asia was the only geographic region to record a rebound in debt offerings. A growing interest in environmental, social and governance (ESG)-related bonds also benefited the region.

In Latin America, Africa and the Middle East, rising global commodity prices elevated gains for the sector’s companies. However, they also pushed inflation higher, leading to a substantial rise in interest rates that ultimately slashed equity gains in the second half of the year.

|

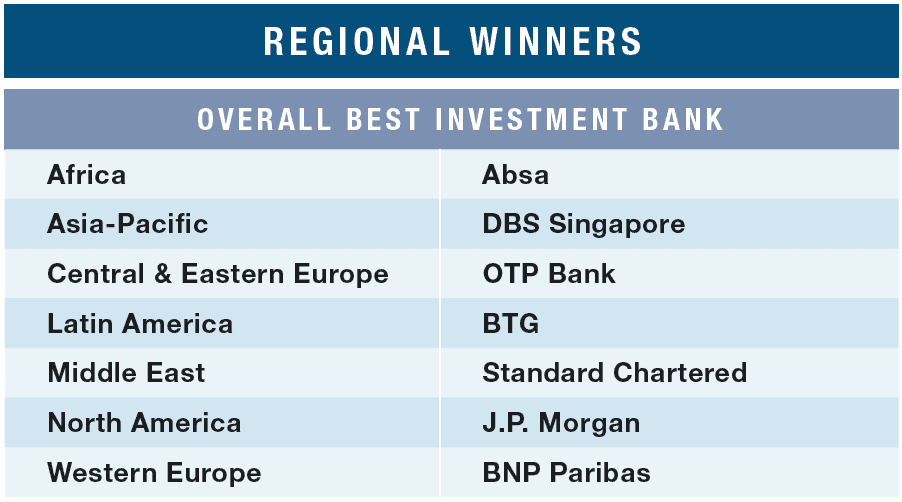

REGIONAL WINNERS |

|---|

AFRICA

Absa

With a presence in 12 markets, South Africa-based Absa is our winner for Best Investment Bank in Africa. The firm delivered a complete investment-banking platform to lead high-profile and innovative financing and advisory mandates across the continent. Absa has participated in transactions within a range of sectors including energy, metals and mining, infrastructure, telecommunications, paper, and real estate benefitting countries across its footprint including Angola, Ghana, Egypt, Kenya, Nigeria, South Africa, and Zimbabwe. Recognizing Africa’s vulnerability to climate change Absa established a target of $6 billion in sustainability lending by 2025 to create solutions to address scarcity of resources and other environmental challenges throughout the continent, and the bank funded four clean energy projects in 2022 for approximately $1.3 billion in aggregate involving wind, solar, and decarbonization strategies. Notably, the bank acted as joint M&A advisor to Egypt’s Infinity Group and Africa Finance Corporation in the $1.5 billion acquisition of Lekela Power, Africa’s largest renewables-focused independent power producer with operations in South Africa, Egypt, Ghana, and Senegal. —DS

ASIA-PACIFIC

DBS Singapore

DBS is the leading equity house, the leading bond house, and the leading M&A advisor in the APAC region, namely Singapore where it ranked first in the equity space for the last five consecutive years. With SPAC’s fast growth in the region, DBS led the first batch of SGX SPAC listings and actively contributing to SPACs market framework in Singapore together with SGX. DBS fixed income team helps clients access the debt capital markets to optimize funding structure and raise bond financing in the Asian and European markets through collaboration with institutional banking groups. Moreover, with its continuous efforts and commitment in sustainability finance, DBS was selected to be a member of the ICMA’s advisory council of Green Bond Principles and Social Bond Principles Executive Committee. In addition, M&A advisory service helps clients accelerate their sustainability strategy with five key themes, from fossil fuels to renewables; corporate restructuring to next phase of growth; transforming Old Economy companies into the New Economy; prolong private equity through private sources; and succession planning for companies with aging founders. —LZ

CENTRAL & EASTERN EUROPE

OTP Bank

Russia’s war in Ukraine was a major inflection point for global capital markets in 2022, adding pressure to the already restrained energy and food markets. However, for the CEE, the impacts were even more significant, given the region’s economic reliance on Russia and Ukraine. But as Russian banks vanished from global market activity rankings on the back of unprecedented western sanctions, others were quick to pick up the slack, providing CEE’s capital markets with much-needed support at a time of crisis. Such was the case of OTP Group, our best investment bank in the CEE. Amid a seemingly slow market, the bank completed the largest-ever acquisition round by purchasing Alpha Bank in Albania and Nova KBM in Slovenia, deepening its position as the region’s leading investment bank. As a result of a well-managed year, OTP’s net interest income and net fee and commission income also saw substantial growth, contributing to a remarkable 76% increase in operating profit in 2022. Additionally, the bank’s cost/income ratio improved by 8.6%, reaching 72.5% in 2022. —TM

LATIN AMERICA

BTG

Amid global central banks’ monetary tightening cycles, the war in Ukraine, and lingering Covid-19 restrictions in China, Latin America emerged as one of the best bets in global capital markets in 2022. That trend was reflected in BTG’s fantastic year. With a return on equity of 20.8%, surpassing its guidance of 20%, revenues of R$17.2 billion, a growth of 24%, and profits rising by 28% to R$8.3 billion, the bank cemented its leading position in the region’s capital market. “This award reaffirms our leadership in the LatAm financial market,” says Roberto Sallouti, CEO of BTG Pactual. “We thank our clients and partners for the recognition while we work relentlessly to continue delivering the best services.” The Brazilian-based giant jumped to first place in the region’s equity capital market with an impressive 16.4% market share, or a nearly 6% growth for the year. BTG also led regional gains in M&A and IPOs despite the general slowdown in activity. BTG’s key market positioning in Brazil also allowed it to take advantage of the country’s thriving corporate debt market and strike impressive deals for the year, gaining significant market share. —TM

MIDDLE EAST

Standard Chartered

With an average tenure of over 50 years among each of the countries in its Middle East banking footprint, Standard Chartered has demonstrated its unwavering commitment to the region. The bank combines extensive sector coverage with collaboration among all areas of the investment bank to provide comprehensive M&A advisory and financing solutions. Through 25 bankers based in Dubai, the bank participated in Saudi Aramco’s $15.5 billion gas pipeline divestiture, where Standard Chartered acted as sole financial advisor to Vision Invest, a Saudi Arabian investment firm that was part of the investor consortium. In Dubai, the bank advised Maritime port terminal operator DP World on the sale of minority stakes in three UAE assets of DP World involving a $5 billion investment by CDPQ, a global investment firm. The bank provided acquisition finance for both deals including $1 billion in financing commitments for CDPQ’s stake in DP World, and a bridge facility to finance the acquisition of a 49% stake in Saudi Aramco’s gas pipeline assets. Its sustainable finance mission promotes social and economic development, and inclusive communities. —DS

NORTH AMERICA

J.P. Morgan

The depressed financial markets during 2022 presented significant challenges for North American investment banks as underwriting mandates and M&A activity dried up, particularly in the second half of the year. J.P. Morgan is our winner for Best Investment Bank in North America, which reflects the depth of its franchise and engagement with clients that contributed to its resiliency in maintaining its league table positions. While the bank continues to dominate the debt capital markets, the bank was able to claim the top spot in equity capital markets fees, both globally and in the US, by participating in notable transactions including IPOs by Corebridge Financial ($1.7 billion), and Porsche ($8.8 billion). The depth of its services strengthens client engagement and is a significant factor with its success in securing deal mandates. In addition to its traditional equity and debt underwriting, and M&A platforms, J.P. Morgan differentiates itself with its Corporate Finance Advisory unit that serves to deepen its client relationships by advising clients on a range of areas including capital structure, risk management, credit ratings, distribution policy, liquidity management, and cost of capital. A ratings advisory team also assists government globally to address issues related to sovereign credit ratings, investor communication and policy impacts. Additionally, to broaden its range of potential clients the bank employs a regional approach in the US through the creation of a dedicated team to serve middle market corporate clients. —DS

WESTERN EUROPE

BNP Paribas

It was a challenging year for capital markets worldwide. However, for Western European investment banks, financial conditions were even tougher, as the combination of higher interest rates, currency devaluation, 40-year-high inflation, and an energy crisis caused by the war in Ukraine created an environment where only the very best were able to thrive. But that’s exactly what BNP Paribas, our best investment bank in the region, did.

BNP’s solid model, strong financials, and impressive dealmaking proved a testament to its resilience, resulting in remarkable figures for the year. The Paris-based bank ranked first place in EMEA debt revenue and syndicated loans, with a 6.2% and 9% market share, respectively. The bank also had an impressive year in convertibles, gaining an astonishing 9% market share for the year, now representing a hefty 16.6% of the region’s market.

Among these deals, the bank acquired FLOA, a web and mobile payment solutions provider, for €258 million, promising to further accelerate the company’s technological revolution. —TM