Islamic financial institutions coped well under pandemic conditions and found that prior tech investments paid off.

The last year wasn’t an easy year for anyone. Lockdowns dampened economic activity to the point that GDP fell nearly everywhere. Major markets in the Middle East and other places where energy is a crucial contributor to the economy faced an additional challenge in the significant decline in the price of oil.

That might have wrought a great deal of damage to Islamic financial institutions (IFIs). Yet banks and other financial entities that operate according to Shariah law performed well overall, according to data from S&P Global. Net profits for the sector fell approximately 10% last year on the back of increased provisioning—less than the decline at conventional banks. Returns for IFIs remained solid at 1.4%, despite falling year over year. Although GDP fell everywhere, most IFIs recorded growth in assets, boosted by increased deposit placements.

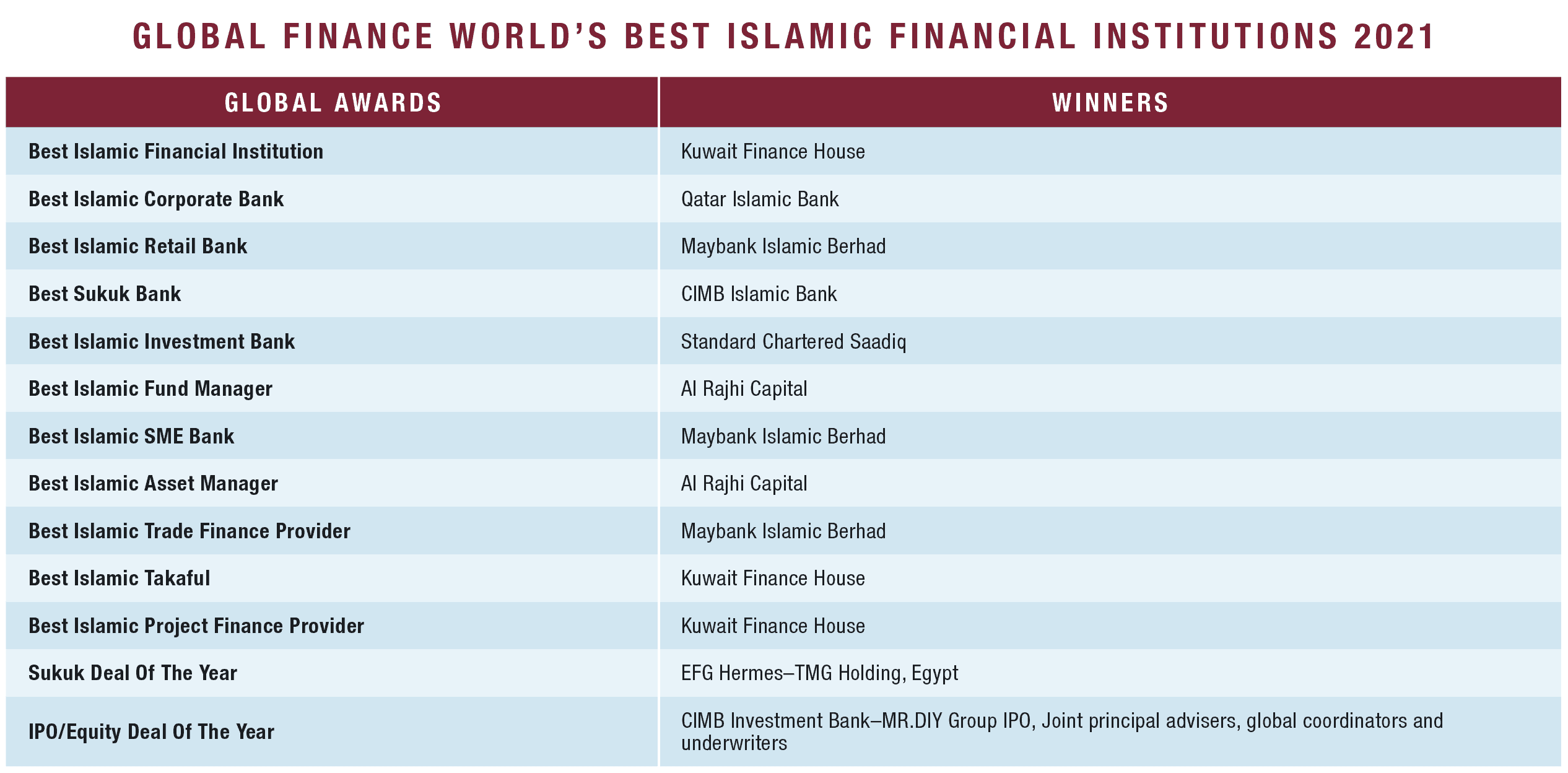

The winners of Global Finance’s Best Islamic Financial Institutions awards for 2021 are those that achieved solid financial performance during this challenging period, together with a widened product portfolio, enhanced service, technology investment and increased market reach.

For many banks, the 2020 pandemic brought forth the rewards of previous investment in technology. One leading example is Kuwait Finance House (KFH), our pick for World’s Best Islamic Financial Institution 2021. KFH has significant market reach across the Middle East, Turkey, Asia and Europe; and its financials, including capital and funding, are strong. But the crisis catapulted an enhanced response.

“The test has proved the prudence of the Group fintech digital strategy, thus enabling us to work during the full lockdown periods,” KFH Chairman Hamad Abdulmohsen Al-Marzouq said in a statement reviewing the pandemic year. “We shall proceed [to] enhance the benefits of digital services and focus on accommodating the most modern and highly sophisticated technologies in the field of internet and artificial intelligence that would enable us to avail all open applications at any time or place.” Digital enhancement remains a key ongoing theme for IFIs.

The consolidation trend in Islamic banking likewise shows little sign of abating. Most recently, Saudi-based National Commercial Bank merged with Samba Financial Group to create the Kingdom’s largest bank, with assets of over $230 billion. Renamed Saudi National Bank, the merged institution began operations in April 2021. Similarly, Indonesia recently finalized the merger of Islamic banking units of three state-owned banks, creating the country’s largest Shariah-compliant bank, with assets of $17.1 billion.

This year will remain challenging for IFIs. Nonperforming loans, and hence provisions, may increase this year as loan-forbearance periods related to Covid-19 end. However, major Global Finance award winners are undergirded by solid financial positions and good franchises.

BEST ISLAMIC FINANCIAL INSTITUTION

Kuwait Finance House

Kuwait Finance House (KFH) wins the global Best Islamic Financial Institution award for the third year in a row due to its continued investment in new products and services, good financial profile and continued focus on technology. KFH has an expanding business outside of Kuwait, from the Middle East to Asia and Europe. In 2020, shareholders and regulators approved KFH’s acquisition of Bahrain’s Ahli United Bank (AUB). However, KFH postponed finalizing the acquisition of AUB due to Covid-19 at the suggestion of Central Bank of Kuwait regulators.

KFH’s range of Islamic banking products and services cover commercial, retail and corporate banking, as well as real estate, trade finance and investments. KFH has placed significant emphasis on digital banking. The bank launched Kuwait’s first digital onboarding solution in 2020 and recently joined up with Aion Digital to digitalize all of KFH’s retail and corporate banking services.

At the end of 2020, KFH’s total assets stood at $71 billion, up by over 10%, with equity of $6.9 billion. Net profit was $600 million while return on average equity was 8.8%, lower than the previous year, as the bank increased credit provisions due to the pandemic and uncertainty on future developments. Financing rose by 13% in 2020 as did depositors’ accounts.

BEST ISLAMIC CORPORATE BANK

Qatar Islamic Bank

Qatar Islamic Bank (QIB) grew its assets by 7% in 2020 to $48 billion with equity of $6.4 billion. Net profit increased to $830 million in 2020, aided by a good performance in the bank’s corporate banking division. Also our winner in the Middle East region, QIB provides a wide range of products and services in corporate banking, from trade finance to structured finance, as well as deposit-related products. It has a strong customer base in government-related entities, financial institutions, real estate, oil and gas, as well as with small and midsize enterprises (SMEs). The bank’s corporate banking service is technology driven, including its Corporate Internet Banking portal. QIB’s net profit is derived 32% from corporate banking. QIB’s cross-border division is also growing.

BEST ISLAMIC RETAIL BANK

Maybank Islamic Berhad

Maybank Islamic (MI) has long been one of the most innovative Islamic financial institutions. It is the largest Islamic bank in Asia, with total assets of $64 billion. It dominates the market in Malaysia, controlling over 30% of the Islamic banking industry. Its products and services are available through a network across Malaysia, Indonesia, Singapore, Dubai, Hong Kong, London and New York. MI’s focus in Singapore positions it as the regional funding center for Islamic banking in the countries of the Association of Southeast Asian Nations (Asean) and a conduit for Islamic funding from the rest of the world into the region. The bank’s expertise in retail banking is significant; and the institution has been particularly innovative over the years, particularly in home finance and savings. In 2020, MI launched a version of its Maybank Anytime Everyone (MAE) that is among Malaysia’s first Shariah-compliant e-wallets, experiencing strong growth in accounts and balances. MI also introduced its Social Impact Deposit account, the first of its kind in Malaysia.

BEST SUKUK BANK

CIMB Islamic Bank

CIMB Islamic Bank is CIMB Group’s global Islamic banking and finance franchise. CIMB Islamic had a strong year in 2020 in sukuk, undertaking many key roles, including global coordinator, principal adviser, lead arranger, lead manager, bookrunner and dealer in a number of important and large deals. These included deals in US dollars, Malaysian ringgits and other currencies. CIMB Islamic Bank is consistently among the leaders in both Asian regional and global sukuk tables.

Prominent deals in 2020 included Axiata Group’s $1.5 billion issuance of sukuk and notes, the lowest-ever 10-year US dollar offering by a Malaysian corporate issuer; Petronas Group subsidiary Pengerang LNG’s issuance of 1.7 billion ringgits (about $410 million) in sukuk Murabaha; Tenaga Nasional’s 3 billion ringgit issuance of wakala sukuk, the largest AAA-rated corporate issuance in 2020 in the Malaysian debt capital markets; and TG Excellence’s 1.3 billion ringgit perpetual wakala sukuk issuance.

BEST ISLAMIC INVESTMENT BANK

Standard Chartered Saadiq

Standard Chartered is a leading player in the Islamic financing industry, particularly investment banking, through its global Islamic banking unit, Standard Chartered Saadiq. The bank’s Islamic investment banking business experienced a successful 2020. The bank is a major participant in the global sukuk market. In 2020, it ranked first in the international sukuk league tables, achieving a market share of 17.7%.

Standard Chartered Saadiq successfully executed a number of high-profile transactions, including several industry benchmark-setting deals, by leveraging its Islamic origination and structuring capabilities with its strong franchise in key Islamic markets and global distribution strength. The bank has played a leading role in assisting most of the sovereigns/governments in the Islamic world with their sukuk funding requirements. There were several landmark deals in 2020 with the governments of Dubai, Bahrain, Indonesia and the emirate of Sharjah. It has also been a leading player in green and sustainable long-term funding structures as well as tier 1 and tier 2 capital raisings for many Islamic banks. Saadiq offers transactional and corporate banking, financial markets solutions such as capital markets and treasury risk management, and other structured solutions.

BEST ISLAMIC FUND MANAGER

Al Rajhi Capital

Saudi Arabia’s Al Rajhi Capital is a leading financial services company, providing a wide range of innovative financial products and services in fund management. Assets under management increased by 19% in 2020 to $13.3 billion. As the fund management and investment banking subsidiary of Al Rajhi Bank, Al Rajhi Capital offers a comprehensive portfolio of professionally managed mutual funds, which include top-ranking and award-winning Shariah-compliant investments.

All equity funds outperformed their respective benchmarks in 2020, including some strong performers such as the Al Rajhi Commodity Fund, which increased by 66%. Al Rajhi Capital also has one of the largest REIT funds in Saudi Arabia. The fund manager improved the functionality of its asset management portal. At the corporate level, Al Rajhi Capital’s net profit more than doubled in 2020 to $172 million. The company also maintains a strong balance sheet and high level of liquidity.

BEST ISLAMIC SME BANK

Maybank Islamic Berhad

Maybank Islamic has an expanding SME financing portfolio, driven by innovative financing products and solutions. MI also offers a number of deposit and investment accounts for SMEs. Other expanding services include business payment solutions, merchant programs, insurance and trade financing. SME Digital Financing allows existing MI customers to apply online 24/7 without additional documents or collateral. They obtain application status within 10 minutes and the financing will be disbursed in as little as one minute.

BEST ISLAMIC ASSET MANAGER

Al Rajhi Capital

Al Rajhi Capital posted record financial results in 2020. The company maintained its first rank in brokerage in the Saudi Stock Exchange (Tadawul) and in the Nomu parallel market, which serves as an alternative platform for companies to go public. Both asset management and proprietary investments performed strongly in 2020. Al Rajhi Capital’s share in the capital markets grew strongly in 2020.

The discretionary portfolio management provides customized private portfolios built on individual assessments of each client’s risk profile. Al Rajhi Capital is considered a pioneer in presenting innovative real estate investment solutions for generating income. Al Rajhi offers a comprehensive range of inventive investment solutions across all other major asset classes including equities, money market, fixed income and multiasset. Despite challenging market conditions in 2020, Al Rajhi’s asset management business performed strongly compared to its peers, led by the increase in assets of the Al Rajhi Commodities Mudaraba Fund. All equity funds outperformed their respective benchmarks during 2020.

BEST ISLAMIC TRADE FINANCE PROVIDER

Maybank Islamic Berhad

Maybank Islamic’s trade finance division performed very well in 2020 and wins the Best Islamic Trade Finance Provider award due to its comprehensive, technologically driven range of products. TradeConnex, a fully functional, best-in-class web-based trade financing service is available to clients. It is designed to increase the efficiency of trade finance transaction processing while delivering an efficient system for reporting and tracing transaction status. Customers can perform and monitor their trade finance transactions online anytime, anywhere. MI offers a full range of Shariah-compliant trade finance products and solutions for both import and export financing.

BEST ISLAMIC TAKAFUL

Kuwait Finance House

KFH Takaful recorded further growth in 2020 with an expanding Islamic insurance product range. KFH Takaful’s wide range of insurance products includes housing, automobile, medical, fire, aviation and marine. The creation of the KFH Takaful app has generated increased customer demand and simplified access to insurance. The company is active in reinsurance programs with many blue-chip reinsurers.

BEST ISLAMIC PROJECT FINANCE PROVIDER

Kuwait Finance House

KFH plays a leading role in financing corporates, specifically project finance transactions. KFH has expanded its trade relations with core corporate clients in all sectors, in a highly competitive environment. Locally, KFH acts as lead arranger for many syndicated transactions. Regionally and internationally, KFH and subsidiaries such as Kuveyt Turk have participated in the financing of many projects for SMEs and large companies.

SUKUK DEAL OF THE YEAR: EFG HERMES

TMG HOLDING, 2 BILLION EGYPTIAN POUNDS

In 2020, EFG Hermes acted as sole financial adviser, lead arranger, bookrunner and underwriter on Egypt’s first-ever corporate sukuk issuance, for TMG Holding. Worth 2 billion Egyptian pounds (about $127 million), the sukuk is publicly traded. The offering was issued by the Arab Company for Projects and Urban Development, a TMG subsidiary, and was 2.5 times oversubscribed during the private placement. The five-year ijara sukuk is intended to fund the remaining capital expenditures for the issuer’s open-air mall in Madinaty

IPO/EQUITY DEAL OF THE YEAR : CIMB INVESTMENT BANK

MR.DIY GROUP IPO

MR.DIY is a Shariah-compliant stock that was listed in October 2020 on the Main Market of Bursa Malaysia, with CIMB as joint principal advisers, global coordinators and underwriters. MR.DIY is Malaysia’s largest home-improvement retailer, with over 670 stores located throughout Malaysia and Brunei as of September 2020. The company’s IPO is Malaysia’s largest listing on Bursa Malaysia’s Main Market since July 2017. It is the largest IPO to date in the retail industry in Malaysia and the second-largest IPO in the retail industry in Asean since 2013.

|

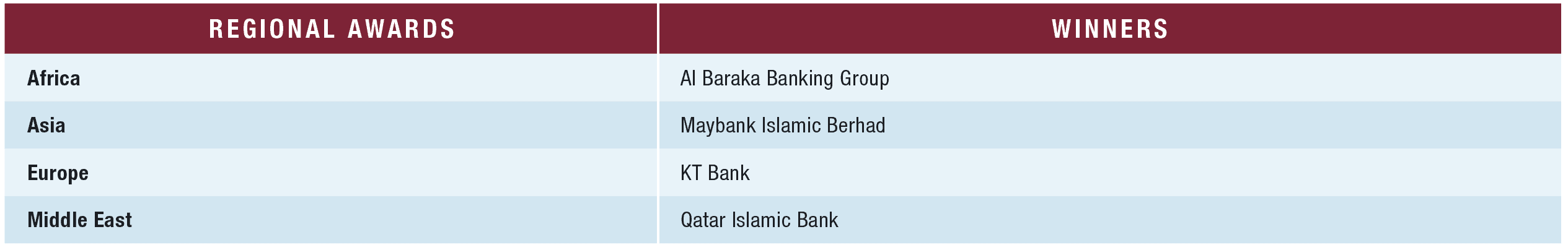

REGIONAL WINNERS |

|---|

AFRICA

Al Baraka Banking Group

Al Baraka Banking Group, headquartered in Bahrain, is the leading Islamic bank across the African continent. Assets rose by 8% in 2020 to $28.2 billion. Al Baraka is present in 17 countries, operating through more than 700 branches. It has the widest geographical reach among Islamic financial institutions, with a strong presence in Tunisia, Morocco, Egypt, Algeria, South Africa, Sudan and Libya. Outside of Africa, it has operations in Turkey, Germany, Jordan, Bahrain, Pakistan, Lebanon, Syria, Iraq, Saudi Arabia and Indonesia. Board member and group CEO Mazin Manna said, in a February statement, “The onset of the pandemic motivated us even more to accelerate the implementation of our strategies in digital transformation in the group and the units to transform our electronic networks into effective platforms to provide all banking services. We will attach great importance to this aspect, as digital banking will be the main channel for customer service and product delivery.”

ASIA

Maybank Islamic Berhad

Maybank Islamic has long been one of the leading Islamic financial institutions globally and has frequently been a first mover in bringing innovative Shariah-compliant financial products to the market. With assets of $64 billion and a financing portfolio of $51 billion, it is the largest Islamic bank in Asia. Its main market is Malaysia, where it controls about one-third of Islamic assets; but its activities extend into Singapore, Hong Kong and Indonesia, with the latter enjoying strong growth. The bank holds an important position in the Malaysian ringgit sukuk market and a good position in global sukuk.

EUROPE

KT Bank

KT Bank, the first Islamic financial institution in the eurozone, recorded high growth in assets over the last few years due to an expanding client base. With a current balance sheet total of around €600 million ($714 million), KT Bank posted rising volumes in the retail, corporate and institutional sectors. With ongoing investment in technology, such as mobile banking, KT Bank is our regional winner in Europe for the fourth year in a row.

MIDDLE EAST

Qatar Islamic Bank

Given the operating conditions and the pandemic, QIB performed well in 2020, with assets increasing by 7%, financing by 5% and net profit rising slightly. The bank’s return on assets remains very good at 1.8%. QIB controls over 50% of Islamic assets in Qatar and is active in the international sukuk market. With the lifting of the boycott, QIB’s regional activities will grow further. The bank’s financial ratios are particularly strong, with an operating efficiency of 20% and Basel III ratio above 19%.

|

COUNTRY WINNERS |

|---|

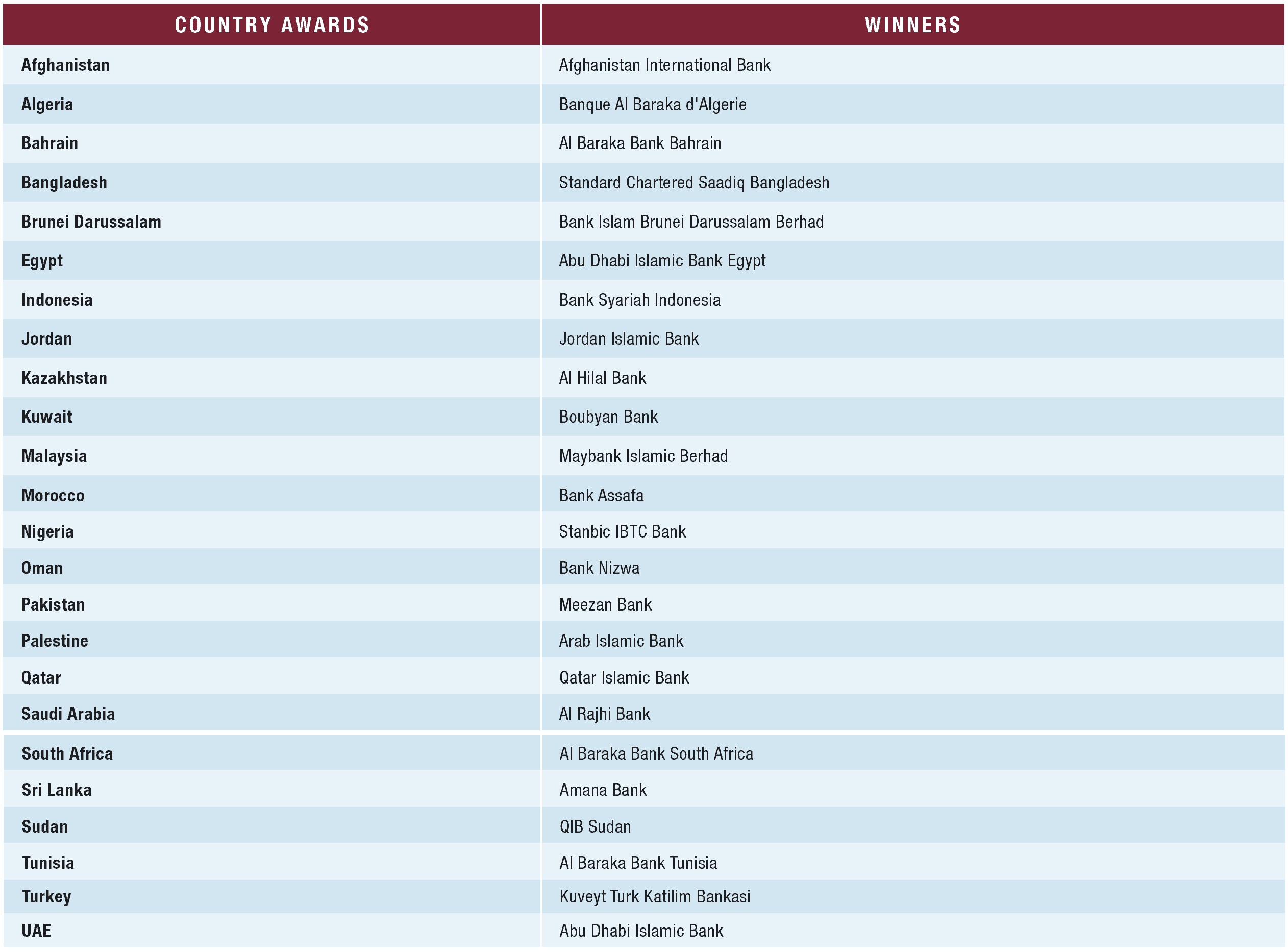

AFGHANISTAN

Afghanistan International Bank

A private institution with its head office in Kabul, Afghanistan International Bank commenced operations in 2004. The bank has assets of just over $1 billion and provides a range of Islamic banking products and services through a relatively wide domestic branch network.

ALGERIA

Banque Al Baraka D’algérie

Banque Al Baraka d’Algerie has assets of $2.2 billion. The bank’s Shariah-compliant banking services and activities in Algeria continue to expand. It serves a growing client base through a network of 30 branches.

BAHRAIN

Al Baraka Islamic Bank Bahrain

Al Baraka Islamic Bank Bahrain, part of the Al Baraka Banking Group, performed well in 2020. Last year, the bank reported a 14% increase in net profit to $6 million. Total assets grew by 20% to reach $2.7 billion. Financing assets have also grown, rising by 12%.

BANGLADESH

Standard Chartered Saadiq Bangladesh

Bangladesh is the fourth-largest Muslim-populated country in the world, which makes it a lucrative market for Islamic banking. Standard Chartered Saadiq Bangladesh saw 7% revenue growth in 2020 with 46% growth in consumer deposits. Standard Chartered is the only multinational bank in the country offering Islamic banking to all client segments across retail, SME and corporate. The bank has state-of-the-art digital capabilities for Islamic banking customers.

BRUNEI DARUSSALAM

Bank Islam Brunei Darussalam

Bank Islam Brunei Darussalam has the dominant position in Islamic finance in Brunei Darussalam and continues to record good growth. It has assets of $8 billion.

EGYPT

Abu Dhabi Islamic Bank—Egypt

A leading institution in Egypt’s expanding Islamic finance market, Abu Dhabi Islamic Bank (ADIB) Egypt had a strong year in 2020. Assets increased by 25% to $4.7 billion, and net profit rose to $76 million. ADIB Egypt has invested heavily in technology, supporting its 70-branch network.

INDONESIA

Bank Syariah Mandiri

Indonesia recently finalized the merger of Islamic banking units of three state-owned banks, creating the country’s seventh-largest bank with assets of $17.1 billion. The three-way merger combined Bank BRI Syariah (the Islamic banking unit of Bank Rakyat Indonesia) with Islamic banking units Bank BNI Syariah and Bank Syariah Mandiri. Islamic financing in Indonesia is growing rapidly, and Bank Syariah is likely to be a strong competitor for conventional banks in Indonesia.

JORDAN

Jordan Islamic Bank

Jordan Islamic Bank is Jordan’s best-performing Islamic bank. The balance sheet grew to $6.8 billion in 2020. The bank has a wide portfolio of Islamic banking products. It is backed by strong regulatory ratios.

KAZAKHSTAN

Al Hilal Bank

The first Islamic bank in Kazakhstan, Al Hilal Bank is the Kazakh subsidiary of the Abu Dhabi Commercial Bank Group.

KUWAIT

Boubyan Bank

Boubyan Bank, majority owned by National Bank of Kuwait, has significant digital capability and has focused on fintech innovation. 2020 was a solid year, with total assets up by 21% to $21.2 billion, financing rising 26% and customer deposits up 17%. Boubyan’s market share of local finance increased to 10% while the share of retail finance increased to 14%.

MALAYSIA

Maybank Islamic

Maybank Islamic is Malaysia’s flagship Islamic institution, with a market share of over 30%. It provides a significant range of products and services and is known for its innovation. In nearly all Shariah areas, it holds a dominant market position.

MOROCCO

Bank Assafa

Bank Assafa is a subsidiary of Attijariwafa Bank, the leading bank in Morocco. Assafa began operations four years ago and has recorded good growth in assets. Assafa benefits from its link with Attijariwafa and the parent’s expertise in retail banking.

NIGERIA

Stanbic IBTC Bank

Stanbic IBTC Bank is a subsidiary of Stanbic Africa Holdings, the large South African financial group. Stanbic IBTC Bank operates a well-managed Islamic banking window in Nigeria that has experienced good growth.

OMAN

Bank Nizwa

Bank Nizwa remains the fastest-growing Islamic bank in Oman. Both its retail and its corporate client bases are increasing, boosted by an electronic channel. Net profit increased by 9% in 2020 and total assets grew by 17% to reach $3.1 billion.

PAKISTAN

Meezan Bank

Meezan is Pakistan’s largest Islamic bank, with a network of 750 branches, and a rapidly expanding asset base of $9.5 billion with growth of 31% in 2020. It offers a range of products and services targeted at the broader public as well as midtier and premium banking customers. Meezan’s net profit increased by 33% in 2020 to $140 million.

PALESTINE

Arab Islamic Bank

Arab Islamic Bank is the oldest and largest Islamic bank in Palestine. The bank currently has assets of $1.6 billion, and experience growth of 22% in 2020 compared with the prior year.

QATAR

Qatar Islamic Bank

QIB is Qatar’s flagship Islamic financial institution, with a market share of 50% of Islamic banking assets in the country. In 2020, QIB became the first bank to access the Formosa market in the Islamic format through issuance of $800 million of sukuk listed on the Taiwan Stock Exchange. “QIB is committed to supporting the diversification of Qatar’s local economy and the development of its strong private sector. We remain focused on continuously enhancing our technology platforms to preempt and satisfy the changing client needs in the digital era, improve our level of services and continue helping our customers and partners succeed,” said Sheikh Jassim bin Hamad bin Jassim bin Jaber Al Thani, QIB chairman, in a statement accompanying the announcement of 2020 results.

SAUDI ARABIA

Al Rajhi Bank

Al Rajhi Bank has been a pioneer in the provision of Islamic retail banking services. At the end of 2020, Al Rajhi was the largest Islamic bank globally with assets of $125 billion and equity of $15.5 billion. Net profit increased to $2.8 billion in 2020. It remains one of the most profitable banks, with a return on average assets of 2.5%. Margins are good and so is asset quality.

SOUTH AFRICA

Al Baraka Bank South Africa

Al Baraka Bank South Africa recorded good growth in deposit-taking activities in 2020, with surplus cash invested in Shariah-compliant equity finance and mudaraba deposits together with advances. The bank offers a wide suite of Islamic financing and investment products.

SRI LANKA

Amana Bank

The biggest player in the Islamic banking field in Sri Lanka, Amana Bank has a good product range. Total assets increased to $540 million in 2020, with stable net profit.

SUDAN

QIB Sudan

Backed by Qatar Islamic Bank, QIB Sudan provides Islamic corporate finance and trade finance solutions to major corporates. It has a good balance sheet and is well managed.

TUNISIA

Al Baraka Bank Tunisia

Part of the Al Baraka Banking Group, the bank has adopted an innovative commercial strategy based on digital technology. It has a wide range of Islamic finance products and services.

TURKEY

Kuveyt Turk Katilim Bankasi

Majority owned by Kuwait Finance House, the bank continues to grow steadily. At the end of 2020, it reported total assets of $21.3 billion, up by 16%. Net profit was up by 9% to $246 million.

UNITED ARAB EMIRATES

Abu Dhabi Islamic Bank

ADIB is a leading bank in the Middle East, with $35 billion in assets at the end of 2020. Its over one million customers benefit from a large distribution network in the UAE. ADIB is present in six strategic markets: Egypt, Saudi Arabia, UK, Sudan, Iraq and Qatar. The bank has invested in its future growth through a digital-transformation program—supporting its award—aimed at enhancing customer service, productivity and focused on generating fee income that is not capital intensive.