Latin America’s best private banks stress client education and digital tools.

The financial strain of the Covid-19 pandemic forced governments in Latin America to dig deep to cover costs. As a growing debt pile looms ever larger, some countries are floating a tax on the wealthy to help foot the bill—one of several ways private wealth counseling in the region is evolving. Big investors continue to grow their money; although it’s not taken for granted—they must pay attention to those increasing taxes and regulations. This is one reason some private banking firms have invested in educating potential investors, especially the rising affluent segment and millennials, leveraging all the technological resources at the banks’ disposal.

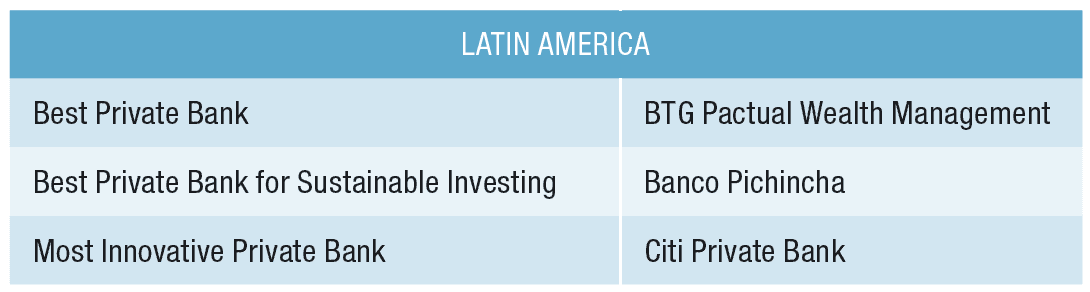

BEST PRIVATE BANK IN LATIN AMERICA

BTG Pactual Wealth Management

Last year, the bank’s wealth management desks showed impressive growth. Revenue increased 26%, due to continuous product-distribution campaigns and innovative investment products such as local real estate funds and alternative investment offerings. BTG Pactual maintained exceptionally high levels of liquidity this year, with record cash flows and one of the highest Basel ratios in the country among banks of comparable size. Its high liquidity level allowed the bank to increase credit offerings at a time when businesses needed it most and other banks limited their offerings. As a result, BTG Pactual’s lending portfolio grew by 68%, primarily consisting of loans to first-rate counterparties with high levels of profitability.

In wealth management, assets under management or custody stood at approximately $23.1 billion in 2020, a 33% increase over 2019. The bank reached a record of around $4.45 billion in net new money for the year, or 162% growth from 2019. BTG Pactual hired 1,400 employees amid the pandemic, mainly in technology and digital retail; while wealth management hired around 30 employees, a 20% increase for the team.

BEST PRIVATE BANK FOR SUSTAINABLE INVESTING

Banco Pichincha

Ecuadorian Banco Pichincha focuses on sustainable finance and offers products and services that address social issues, such as financial inclusion and support for women entrepreneurs, as well as environmental strategies, with green financial products and environmental incentives. The bank aims to improve the quality of life through sustainable management models that leverage responsible finances and generate economic and social growth.

Banco Pichincha was the first company in Ecuador to sign the United Nations’ Women’s Empowerment Principles and to join the Global Banking Alliance for Women, which supports programs that foster financial growth.

The bank’s microfinance segment promotes responsible, efficient and sustainable operations that generate development and greater well-being for customers, their families and communities.

Banco Pichincha provides a comprehensive portfolio of financial and nonfinancial products and services designed to be activated by the customer’s voice, and digital tools that allow bank employees to provide immediate responses to clients in an agile and secure fashion.

In 2020, the bank served 263,431 microentrepreneurs. The total portfolio balance reached approximately $1.2 million, with $285 million in liabilities. Banco Pichincha disbursed $957 million in 246,000 operations. More than 80% of this amount was directed to the economic reactivation of its clients’ businesses.

MOST INNOVATIVE PRIVATE BANK

Citi Private Bank

With approximately 200 million customer accounts spread across 160 countries and jurisdictions, Citibank is one of the best-capitalized banks in the world. It provides consumers, corporations, governments and institutions a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services and wealth management.

In Latin America, Citi has had a prominent position in the financial services industry since 1904, when it started operations in Panama through the International Banking Corporation. In 1914, Citi opened its first international branch in Buenos Aires, making it the first foreign-established branch of any nationally chartered US bank. Citi quickly set up a similar presence in Rio de Janeiro.

The bank accelerated its digital transformation throughout 2020. It increased the number of users connecting through digital channels, with the broad adoption of application programming interfaces and the increased number of digitally opened accounts. Citi has deployed more digital onboarding capabilities, enabling clients to open accounts using e-signatures in 50 countries. The bank’s digital channels remain pivotal in helping clients with operational resiliency while operating remotely or in continuity-of-business mode.