Strategic acquisitions spur competition in the US regional markets.

Although regional US banks cannot match the pedigree or global reach of private banking titans like J.P. Morgan and Citi, an ongoing consolidation process should make the regional banks more competitive. Just in the past year, PNC Financial acquired BBVA USA, including the Spanish bank’s US wealth business, BBVA Compass; SVB Financial Group, the parent company of Silicon Valley Bank, purchased Boston Private; and Canadian giant Scotiabank announced that it is looking for a US acquisition to bolster its wealth management business—no surprise, perhaps, given that a booming stock market has produced more high-net-worth individuals (HNWIs) in the US than ever.

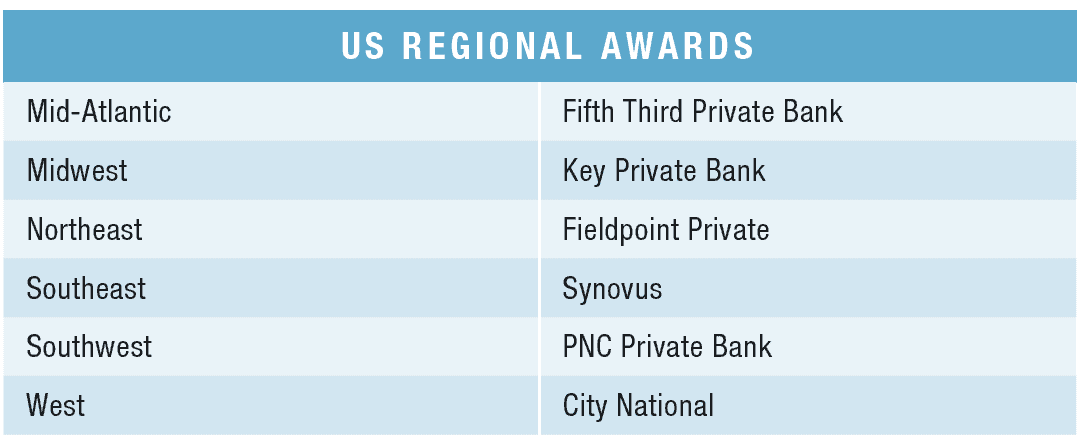

MID-ATLANTIC

Fifth Third Avenue Private Bank

Digitalization and sustainable investing are two of the top global trends among private banks in 2021; and Fifth Third has helped lead the charge in digitalization among US regionals, as evident in its transformed private bank client-onboarding process.

By coordinating and integrating an operation that included the introduction of an e-signature offering, cost-basis reporting service, automated customer account transfer service and, more recently, a process from Delta Data that simplifies the transfer of assets between bank trusts and other financial offerings, the private bank cut down client onboarding from weeks to a matter of days and sometimes even within 24 hours.

The institution, which can trace its history back 160 years, provides bespoke wealth management offerings to HNWIs in the Midwest and Mid-Atlantic regions. There wasn’t any reversal in 2020, as total client assets under management (AUM) in the private bank grew to $54 billion.

MIDWEST

Key Private Bank

Key Private Bank, a provider of wealth management solutions and advice for HNWIs and ultrahigh-net-worth individuals (UHNWIs), has become an important driver of fee income at Ohio’s KeyBank. Key Private had $47.7 billion in AUM as of June 30, 2021, up strongly from $39.7 billion a year earlier.

The private bank offers wealth advice, investment management, trust administration, custom credit and family office services—combining market insights of local advisers with a national team of wealth and investment strategists to deliver personalized client advice. It operates in 15 US states.

Parent KeyCorp traces its roots back 190 years to Albany, New York; but most today know it better as a Midwestern institution headquartered in Cleveland. However, Key Private has recently been expanding operations to locales closer to its 19th-century origins, such as New England.

“New England is a critical market for Key Private Bank, and we are continuing to hire and invest in talent,” says Key Private Bank’s New England market leader Tony DiSotto. The move is consistent with other large US banks expanding their private banking workforces to take advantage of the favorable macroeconomic climate, bolstered by a booming stock market, stimulus checks and other factors.

NORTHEAST

Fieldpoint Private

Fieldpoint Private is one of the country’s fastest-growing wealth advisory and private banking boutiques. Founded by 31 partners in Connecticut in 2008 with “a philosophy of exclusive membership and client-centricity,” it has since expanded into New York City, Georgia and Florida. It recently surpassed $5 billion in AUM.

Catering to “highly successful individuals, families, businesses and institutions,” Fieldpoint offers wealth-transfer advice, tax planning, aggregation and performance reporting, risk management, goals-based investing strategies, investment selection, personalized banking, customized credit solutions, bespoke custody and trust solutions, as well as concierge services.

In August, Fieldpoint announced that it had notched year-over-year growth of 21% in loans, 24% in bank deposits and 25% in wealth management assets—and surpassed $1 billion in balance sheet assets for the first time.

SOUTHEAST

Synovus Bank

Synovus Bank has had a family office business since 1947 and is dedicated to serving UHNWIs and families across the United States, especially multigenerational families. The unit has 40 team employees, some $10 billion in assets under administration and an award-winning specialty in philanthropic services.

Although Georgia-based Synovus is a regional institution with 285 branches in Georgia, Alabama, South Carolina, Florida and Tennessee, its family office is more outwardly focused, providing investment management, wealth-transfer planning, family enterprise management and fiduciary services to families in North and South America, Europe and the Middle East.

With a strong contribution from the family office unit, fiduciary and asset management fees at Synovus Bank increased by $6.6 million (22%) for the six months ended June 30, 2021. The increase was driven by growth in total AUM, which increased by 28% from June 30, 2020, to $21.23 billion on June 30, 2021.

SOUTHWEST

PNC Private Bank

PNC Financial’s June purchase of BBVA USA Bancshares transformed PNC Bank into a rising star on the regional private banking stage.

The bank recently merged its PNC and BBVA USA wealth businesses and rebranded it as PNC Private Bank. The private bank remains part of PNC’s asset management division and focuses on affluent emerging, established and multigenerational segments.

The high-net-worth client segment is increasingly appealing to many US banks. “It’s an attractive sector,” Carole Brown, who heads PNC’s asset management segment, told Bloomberg in an August interview, pointing out that her business offers the highest returns of PNC’s three reportable segments-even though it’s the smallest. “The opportunity I think that all of us are trying to position for is this multitrillion-dollar wealth transfer that’s happening and will continue to happen over the next decade.”

As noted, many US banks have been expanding their private banking units recently, and that creates challenges of its own. “The biggest challenge I see in 2022 evolves around talent,” says Don Heberle, who heads PNC Private Bank. “This is one of the most competitive environments I have experienced, in terms of hiring new talent and developing our current employees.”

WEST

City National

AUM at City National Bank has soared lately, driven by its expanding private banking business. So it’s no surprise that the Los Angeles–based bank reprises the role it played two years ago as Global Finance’s Best Private Bank in the West.

A subsidiary of Canadian banking giant Royal Bank of Canada, City National offers banking, trust and investment services through its 75 offices, including 19 full-service regional centers, in Southern California; the San Francisco Bay Area; Nevada; New York City; Nashville; Atlanta; Washington, DC; Minneapolis and Miami.

In May, the bank hired a new cross-border banking team in New York. In June, City National announced hiring a new team of private bankers to serve the greater Philadelphia area, specializing “in the unique financial needs and challenges of ultrahigh-net-worth clients.” This followed the bank’s naming of Abel Montañez as head of its private banking division.

Like most private banks serving UHNWIs, City National’s services are broad and highly personalized. The Philadelphia team, for example, offers advice and services in investment management, customized credit, depository and cash management, wealth planning and trust services, to business owners, entrepreneurs, corporate executives, real estate professionals, professional-sports team owners, family offices, family foundations, and hedge fund and private equity principals and funds.

City National anticipates further growth in its wealth segment in 2022, as many expect interest rates to rise. “US wealth management is well positioned to benefit from rising interest rates, given the asset-sensitive nature of City National Bank’s balance sheet,” said RBC CEO Dave McKay in a second-quarter earnings call. City National’s AUM stood at $70.3 billion on July 31, 2021, up from $58.6 billion a year earlier.