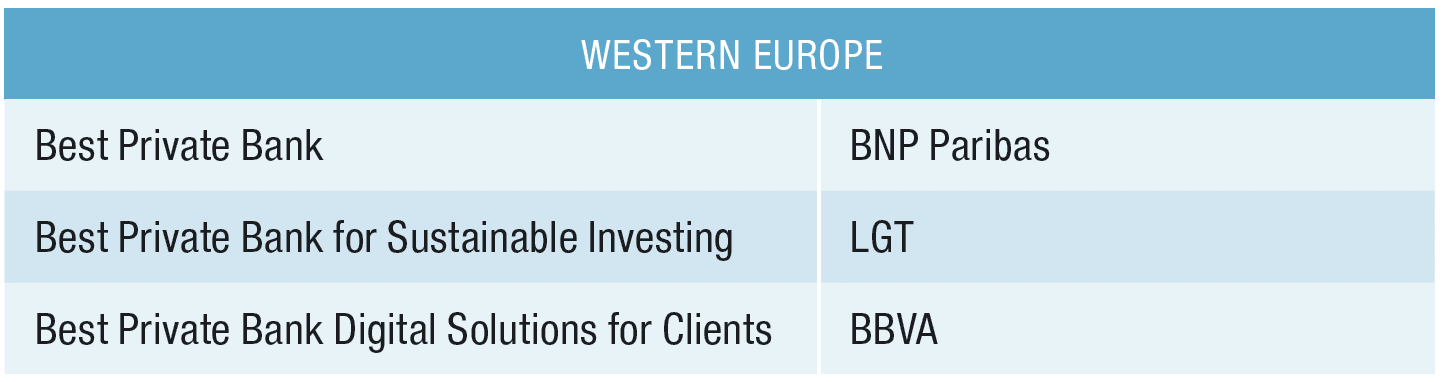

Global Finance announces the best private banks in Western Europe.

Western Europe’s private banks enjoyed exceptional business levels and profits in 2021. Assets under management (AUM) grew by 12%, according to McKinsey’s annual private banking survey, largely due to favorable market conditions. Net inflows of client money doubled to 4%, while lending volumes grew by 7%. Profit margins were up and, while there were some notable exceptions, European private banks generated near-record profits and justified their reputation as the crown jewel of the sector.

Yet costs continue to rise, as private banks step up investments in technology and training to revive personalized relationships in the increasingly digitalized world. Further, government largesse has given way to inflation and rate hikes. The recent sharp market downturn already reduced AUM for most wealth managers. Private bankers must assist increasingly risk-shy investors and attract new money amid high market volatility.

BEST PRIVATE BANK IN WESTERN EUROPE

BNP Paribas

Following a stellar performance in 2021, last year’s winner, BNP Paribas Private Banking, outpaced most of its European rivals in the first half of 2022 by attracting nearly €2.8 billion ($2.9 billion) of net asset inflows in its core markets of France and Belgium alone, mainly though new-client acquisition and by extending already strong relationships with entrepreneurs. BNP Paribas is effectively the region’s largest private bank and the clear leader in its core French and Belgian markets. It is extending its presence in the Netherlands and its offerings to ultrahigh net worth clients in Germany, while also establishing a strong franchise in Asia-Pacific and the Middle East.

The strong commitment to digital at parent BNP Paribas has brought a wave of apps specifically for private banking customers. One key innovation is the PaxFamilia app, developed by BNP Paribas Fortis in partnership with fintech Guiscare and now the basis of wealth management across all jurisdictions. “A fully remote bank would offer all kinds of banking services purely through digital means,” explains Stéphane Vermeire, head of private banking and wealth management. “Our ‘digital-conversational bank,’ however, goes well beyond this sole objective of digitizing banking services and enables clients to interact with their relationship manager—or the bank as a whole—to get personalized advice.”

BEST PRIVATE BANK FOR SUSTAINABLE INVESTING

LGT

While many European royals highlight environmental issues, but only Liechtenstein’s princely family has served these causes by embedding sustainable objectives into a bank’s investment strategies. As LGT Private Bank’s majority owners, they have been fostering sustainability in the financial sector for nearly two decades. The bank’s chairman, Prince Max von und zu Liechtenstein, is forceful in arguing that doing good and generating attractive investment returns do not have to be mutually exclusive. LGT tracks the ESG performance of nearly 10,000 companies and translates this data into a sustainability rating for the corresponding equity or bond, delivering transparent and easily comparable information to help clients align their portfolios with their values. During the past year, it launched its second dedicated impact fund, in conjunction with ESG specialist investor Lightrock, an LGT offshoot, to invest in companies who seek market-oriented returns and whose activities have a measurable positive impact on greenhouse gas emissions and climate change.

BEST PRIVATE BANK DIGITAL SOLUTIONS FOR CLIENTS

BBVA

BBVA continues to invest in innovation as a driver of growth. While a significant share of investment goes into making back offices and platforms more robust and secure, it is also upgrading its customer relationship management and big data capabilities to enhance monitoring of investments, alerts and global client management, using client-ranking algorithms based on clients’ individual preferences and priorities.

The bank’s client reporting platform now provides a customizable experience in digital channels designed specifically for each customer’s portfolio, while its digital wealth planning is delivered through personalized and actionable journeys. A third of all BBVA private banking clients have embraced these digitized relationships, though they are designed to complement rather than replace the human links between each client and that client’s relationship manager.