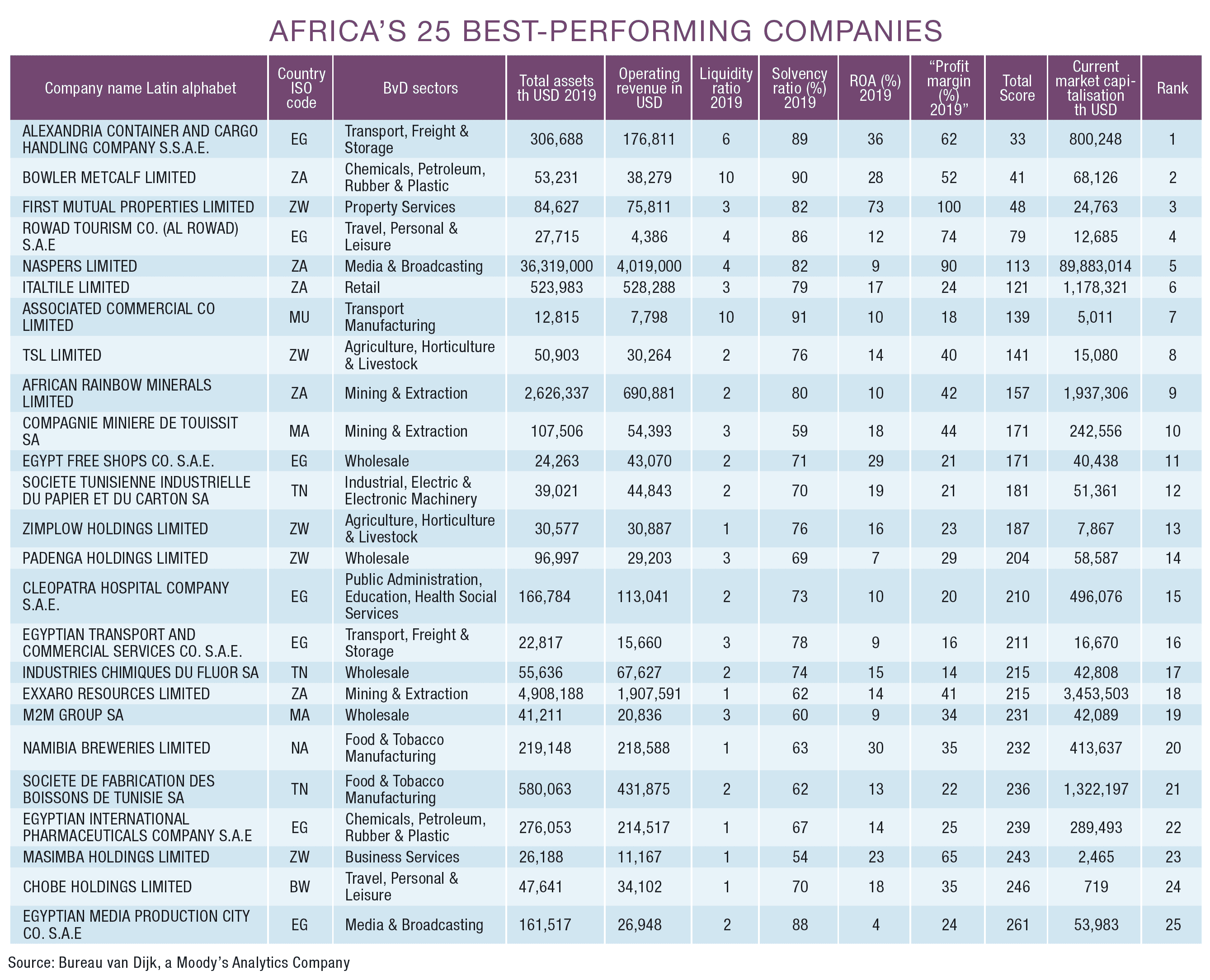

African economies face especially tough barriers to post-Covid-19 recovery. Global Finance names the top 25 best performing companies throughout Africa.

The 25 businesses that make up Global Finance’s list of the top-performing companies on the African continent represent a broad range of industries, from mining to manufacturing, from wholesale to health care. With seven ranked companies, Egypt contributed the greatest number to this list, which Global Finance’s editors derive each year from data supplied by Bureau van Dijk, a Moody’s Analytics company.

These economic engines will need all their expertise and foresight as they look to weather the Covid-19 crisis and prosper once it abates. Even before the outbreak, they were negotiating a difficult environment in which some of the continent’s biggest economies were experiencing an economic slowdown.

South Africa, with five companies in the rankings, is one of several that were already hurting, “pretty similar to the rest of the world,” says Eric Gaus, economist and assistant director at Moody’s Analytics. “It was slowing down a little because of slower trade flows, primarily stemming from US trade war with China.”

If South Africa, Nigeria and other countries seemed to be hitting the economic doldrums, the continent still has its bright spots. Tanzania was a “star performer,” says Gaus; in fact, before the Covid outbreak, Tanzania’s National Bureau of Statistics had expected a 3-4% increase in GDP in 2020. Botswana’s economy was similarly strong, with officials there predicting 3% growth in the GDP prior to the outbreak.

Amaka Anku, Africa practice head at the Eurasia Group, notes that nearly half of the continent’s GDP comes from three countries: South Africa, Nigeria and Angola. Those economies had been stagnating pre-Covid while smaller economies, such as Senegal, were expanding.

Covid-19 threw a monkey wrench into both groups. In the most recent edition of its biannual Africa Pulse report, the World Bank predicts that significant Covid-19-related economic contractions in South Africa will fuel Africa’s first recession in 25 years, with growth declining as much as 5% this year. South Africa’s economy contracted more than 50% in the second quarter, thanks in part to stringent Covid-19 lockdown restrictions.

Roads To Recovery

Post-Covid-19, Africa’s economies will align with their pre-pandemic status, Anku predicts; South Africa, for example, which was already slowing, will continue to poke along. Economies that were growing before the pandemic will continue to expand, only in a new, diminished global setting. To grow their presence in global trade, Anku argues, African governments will have to tackle long-standing economic inhibitors: corruption, lack of infrastructure, lack of education, poverty and lack of health care.

Looking at individual sectors, Gaus says Africa’s greatest economic strength continues to lie in its mining, quarrying and resource-extraction capabilities. Companies operating in these sectors will rebound fairly quickly, he predicts. Perhaps least affected by the Covid-19 shutdowns is agriculture, which constitutes 20% or more of the economies of Ethiopia and Kenya, among other African countries, Anku notes.

“Covid restrictions applied primarily to cities,” she says. “Nobody was going to rural areas and telling people not to farm. In fact, many countries exempted farming [from Covid restrictions], calling it an essential activity.” A smaller contraction likely means a quicker comeback, she says, although imports of seeds, seedlings and equipment may prove more difficult.

At the other end of the spectrum, Gaus predicts a long and arduous recovery for tourism-dependent economies. Island nations such as Mauritius, Madagascar and Seychelles are almost entirely reliant on tourist spending and even larger countries such as Kenya have come to depend on visitors. Tourists still will not feel safe, even after an effective Covid vaccine appears, says Gaus, because infrastructure issues on the continent will make it difficult to distribute the medicine.

“It’s challenging to know what’s happening, where the virus is, how it’s spreading,” says Gaus. “When thinking about the economic future for Africa, we’re looking through a fog.”

Methodology

The 25 Best-Performing Public Companies in Africa ranking evaluates nonfinancial companies on four measures: liquidity, solvency, return on assets and profit margin. We analyze the data for the top 350 companies by market capitalization.

Firms are given a score on each measure, and those figures are totaled to create an overall score. A low score on each measure is equated with best performance, and the company with the lowest overall score places highest in the ranking.