Global Finance rates the top financial innovations of the last 30 years, looking at where we are, where we’ve come from and how we got from there to here

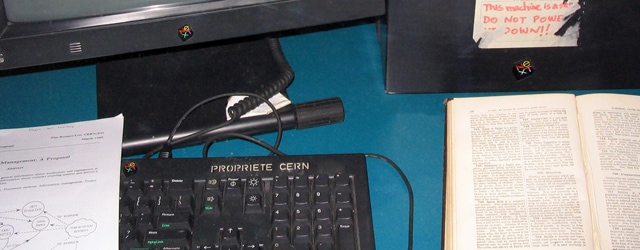

Technology has dominated the past 30 years—fundamentally changing the way that we work, rest and play. The invention of the World Wide Web in 1989 by Tim Berners-Lee paved the way for a connected digital world where we can communicate with anyone, anytime and anywhere. The digital revolution, paired with a wave of de-regulation in the 80s and 90s, set the stage for massive innovation in finance.

Like countless other industries, the finance sector, although slow to respond, has been profoundly altered by the ensuing disruption. Taking heed from the bumpy ride endured by the music industry (which is recovering and growing digitally but will never return to the sales it enjoyed in the ’80s and ’90s) and the grisly fate of Blockbuster (which failed because it ignored the shift from video rentals to streaming), banks understand the need to adapt or die.

To coincide with Global Finance magazine’s 30th anniversary, we convened a panel of experts and surveyed our readers for their insights on the biggest finance innovations of the past 30 years. Many nominations, such as robo-advisory and virtual payments, emerged from digital technology. But deregulation also sparked new products and policies. Eurobonds, target-date funds and TIPS, for example, won many votes, although they did not make the final cut. Likewise, several policy ideas that readers nominated—Basel Accords, quantitative easing, SEPA—ultimately fell out of the top 10.

“For sure the repeal of Glass-Steagall was incredibly impactful, but I don’t necessarily view that as innovation,” says review panelist Helen Shan of consulting firm Mercer, explaining a logic many shared. “That might have led to innovation, but that’s a different way of looking at it.”

Unsurprisingly, technology-based innovations such as online banking, ecommerce and mobile payments/banking/virtual payments scored highest. “[Online banking] has permanently transformed the interaction between banks and customers, by not only creating simplicity and convenience, but reducing cost for both,” says panelist Guillermo Gualino, vice president and treasurer for Agilent Technologies. “Online banking has created new business models even for services that have historically been commoditized, such as payments.”

FROM REVOLUTION TO EVOLUTION

ATMs, along with Big Data/data analytics and cybersecurity, ranked fifth, fourth and sixth with our readers; yet our group of experts were not impressed. ATMs, experts noted, first appeared 50 years ago. Yet their nomination by readers shows their impact is still felt today.

“The first innovation is just a starting point,” says panelist Sankar Krishnan, executive vice president of capital markets and banking at Capgemini “ATMs

enabled credit cards to be used more; this resulted in debit cards, prepaid cards etc., which in turn spurred internet banking, the success of which moved the needle on mobility for digital-first consumers. So almost always innovations start somewhere and, when they succeed, end up spurring new innovations.”

For our experts, the asset-backed securities (ABS) and exotic derivatives/collateralized debt, the Black-Scholes formula and algorithms, high-frequency trading and ETFs (exchange-traded funds) all ranked highly. These innovations, which helped increase market liquidity and thus finance global development, were of far less importance to our readers. “The world has gone through a lot in 30 years—wars, floods, famines, market crashes, hell freezing over—and what has kept it together is the ability to manage risks through derivatives,” says Krishnan. “I will also say that trade finance—which includes commodity, export finance and supply chain finance—is a close second, as it has enabled the growth of global trade. Derivatives and trade finance are the equivalent of the ATM for retail banking. And, like the ATM, every year they get better with both the technology aspect and the utility aspect. They accelerated global finance and global businesses to new heights. Arguably the most important finance products used by corporations and banks in the last 30 years.”

Not everyone agrees on what constitutes a top innovation. Economist James K. Galbraith, for example, says the complexity of ABS makes them perfect vehicles for fraud. “They permitted the record of fraud to be concealed in the files of the mortgage originator, and they permitted the ratings agencies to pretend that synthetic CDOs [collateralized debt obligations] were ‘diversified’ and therefore safe. And they fostered the issuance of CDSs [credit default swaps] by a firm [US insurer AIG] that could not cover its cash collateral clauses.” Gualino acknowledges those issues but counters: “The merit of an innovation is sometimes measured by its creative and game-changing process, as opposed to the end result.”

THE PAST DEFINES THE FUTURE

Both experts and readers ranked blockchain, microfinance and peer-to-peer funding fairly highly. These all promise greater transparency, so can be seen as a reaction to the financial crisis. While blockchain guarantees an immutable record, Krishnan says the rise of fintech targeting crowdfunding and peer-to-peer lending has helped improve the quality of the underlying assets and the transparency that this brings to the entire ecosystem.

The digital world is in a constant state of flux. Today’s pocket-sized smartphones, for example, are more powerful than the supercomputers of the 1980s, which filled entire rooms; so the rise of mobile banking, mobile wallets and mobile payments has required banks to focus much of their innovative energies on ensuring that they can keep pace with nonbank alternatives.

It has been a steep learning curve for the finance sector—Amazon began only in 1995 and eBay popped up about a year later. Back then, Forrester Research predicted that the online retail business would hit $250 billion by 2014, when in fact it reached over $750 billion.

Paolo Sironi, fintech thought leader for IBM Watson Financial Services, thinks bankers still need to alter their mindset, “a change from a distribution channel for products towards a distribution channel for advice, where software can automate at least some of the process, transforming advisory from a transaction-oriented business to providing more longer-term services to clients.”

Disruption and transformation have been the buzzwords of the past decade—an eventful ride with countless twists and turns. Just as Berners-Lee’s creation of hypertext protocols, which enabled the Internet to develop beyond its previous limited network of scientists, geeks and the military, brought about unimagined worldwide communications, the consequence of finance innovations is as yet unknown.

“The amalgam of open and shared data, artificial intelligence, cognitive computing, machine learning, distributed-ledger technologies and robotics will convulse and transform society and its frameworks for cohesion as we know them today, stressing and, in some cases, overturning established ethical—as opposed to commercial—value systems and the political structures that buttress them,” says Jeremy Wilson, vice chairman at Barclays Corporate Banking. “The top 10 innovations of the last 30 years are predecessors and will be eclipsed by what is now coming.”