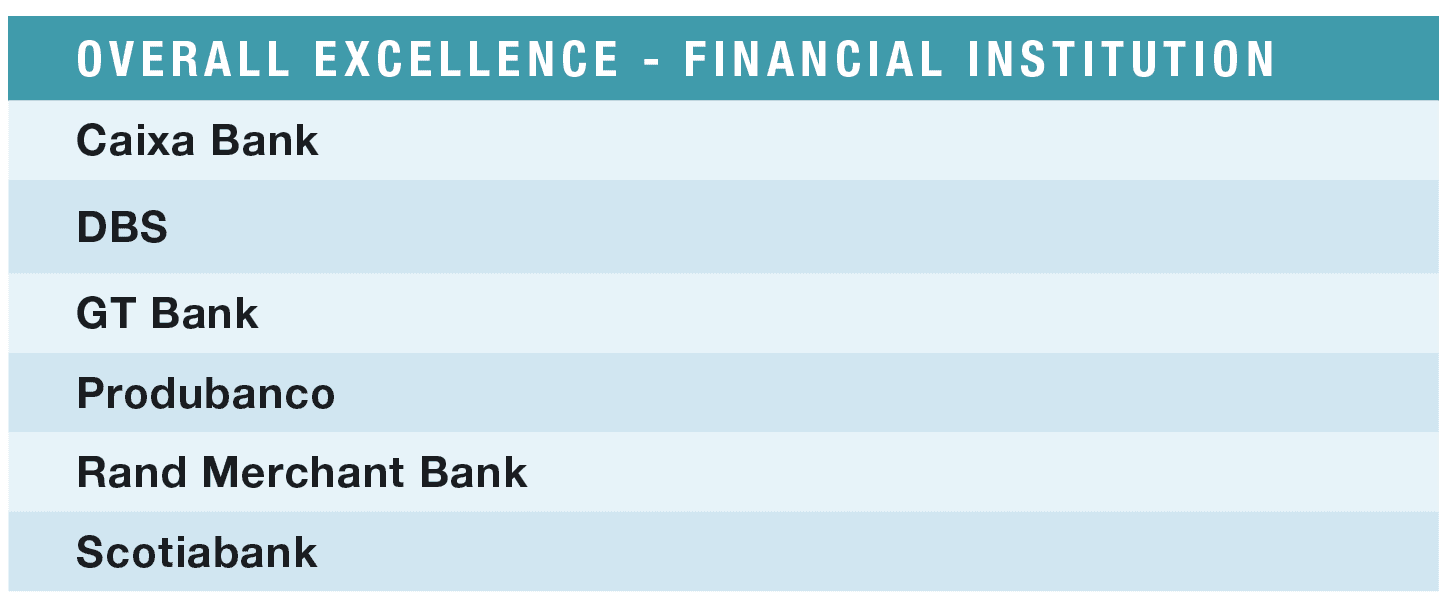

These banks provided financial support and more—for their employees, their clients and their countries.

CAIXABANK

CaixaBank focused considerable effort on meeting the financing demands of the business sector and minimizing the economic impact of Spain’s lockdown. “Since the outbreak of the pandemic until September 30, CaixaBank has granted €51.5 billion in financing to business—in addition to processed loans linked to the Spanish government’s ICO Covid-19 credit facilities—for a total amount of €15.1 billion” says CEO Gonzalo Gortázar. “It is worth highlighting that 76% of the amount [was] disbursed to the self-employed and SMEs [small to medium-sized enterprises].”

As more than 60% of Spanish GDP is generated by SMEs, they will play a key role in the country’s economic and social recovery. Aiming to extend support to those most affected by the pandemic, CaixaBank has approved close to 400,000 repayment moratorium requests, worth €11 billion and representing 20% of the total approved in Spain. “We have also issued a €1 billion Covid-19 social bond to fund SMEs and microenterprises located in Spain’s most underdeveloped areas,” says Gortázar.

CaixaBank also launched a support scheme for small retailers that provides funding, reduced point-of-sale fees and promotional help for online sales through e-commerce technology solutions that help retailers sell via social networks and messaging applications.

DBS BANK

In addition to rolling out relief packages to help businesses in Singapore cope with the Covid-19 crisis, DBS has undertaken a slate of initiatives geared to bolster its workforce and the wider community.

Karen Ngui, managing director and head of group strategic marketing and communications, points to the bank’s creating of the S$10.5 million DBS Stronger Together Fund to provide 4.5 million meals, care packs and medical supplies across DBS’ footprint in Asia. “We also implemented new measures to enhance and protect the well-being of our people,” Ngui explains, “including the introduction of health care and wellness programs and new initiatives to help staff to transition seamlessly to working from home.”

Other initiatives include digital, contact-free trade financing capabilities, targeted financial and health care solutions for self-employed individuals and gig workers, and complimentary insurance coverage for customers.

“DBS remains firmly committed to protecting lives and livelihoods, helping businesses leverage digitalization to tap into new opportunities and embracing a new way of working so that we can all emerge from the pandemic stronger together,” says Ngui.

GAURANTY TRUST BANK

At the outbreak of the pandemic, Guaranty Trust Bank launched a slate of programs and initiatives to safeguard lives and livelihoods. Its most remarkable achievement was a 110-bed isolation center to care for victims of the virus that the bank built in Lagos, in collaboration with the state government, in a matter of days.

GTBank also plays a leading role in the Private Sector Coalition against Covid-19 (CACOVID), through which private-sector organizations worked with the Nigerian federal government, the Nigeria Centre for Disease Control (NCDC) and the World Health Organisation to combat the pandemic. Participating organizations have equipped medical facilities across the country to ensure Nigerians have adequate access to testing, isolation and treatment facilities and trained personnel.

With the economy fully on lockdown by April, GTBank’s customers were already feeling impact of the pandemic. Loans were not being serviced, which ordinarily would lead to higher interest costs. To stave off more pains for affected customers, GTBank granted a 90-day grace period—later extended another 90 days—on all loan repayments by small businesses. “As small businesses have stayed closed to stay safe, they need all the help they can get,” the bank said in a statement.

PRODUBANCO

Produbanco was well prepared for the pandemic-driven surge in demand for online services, thanks to its early transition to digital channels including online and mobile services.

“Besides offering the main banking transactions, we have been offering new services which are very useful for the customer,” says CEO Ricardo Cuesta Delgado.

Produbanco has been active within the larger community as well. The indigenous peoples of Ecuador’s Amazonian region have been hit hard by the coronavirus, despite their isolation, and lack of clean, running water makes hand-washing difficult, putting entire villages at risk. Produbanco donated $1.5 million to the Por Todos (For Everyone) fund for measures to control the spread of the virus and provide health care and food to sustain Ecuador’s 250,000 isolated indigenous people. It also established alliances with international NGOs operating throughout Ecuador. The bank has also worked closely with Su Cambio por el Cambio (Your Change for the Change), a foundation that assists Ecuador’s underprivileged communities.

RAND MERCHANT BANK

Rand Merchant Bank seems to be everywhere at once supporting Covid -19 relief. Together with the FirstRand Foundation and First National Bank, RMB committed R100 million as an anchor investment into the First Rand’s South African Pandemic Intervention and Relief Effort (SPIRE), which is driven by a group of volunteers from across the FirstRand group to assist frontline health care workers. SPIRE works closely with the Solidarity Fund, Business for South Africa (B4SA) and other industry and sector initiatives.

Funds have been used to import Covid-19 testing kits, increase ICU funding, buy personal protective equipment and respirators, and develop the Intubox, which protects hospital workers and critical-care patients from airborne, virus-spreading particles.

RMB also distributed funds to non-profit organizations to supply food parcels to vulnerable households across the country. Partnering with the Johannesburg Stock Exchange on the #Trade4Solidarity initiative, it donated trading and clearing fees over two days to the Solidarity Fund. The RMB Executive Committee agreed to forgo 30% of their salaries for three months, with proceeds going to SPIRE.

RMB has supported the arts during the pandemic as well, contributing R75,000 to South African creatives infected or affected by Covid-19 along with donations to an orchestra and choir and to the Lockdown Collection, which supports local artists impacted by the pandemic.

SCOTIABANK

Canada’s third largest bank by assets, Scotiabank moved quickly to shutter branches and office locations after Covid hit—many remain that way—while simultaneously building up its digital resources across borders. Its strategy centers on “digital factories,” physical hubs for technology teams with expertise in each of its core markets: Canada, Mexico, Chile, Peru and Colombia. While collaborating with one another, each factory has rapidly developed regional solutions, which they were able to share code reuse design patterns across borders. Leveraging technology and processes in this way enables the bank to rapidly create new systems to serve its global clients.

Through its Canadian retail operations and its Tangerine direct banking subsidiary, Scotiabank has provided more than $50 billion in financial relief to more than 360,000 customers. In Chile, Colombia, Mexico and Peru, Scotiabank has processed some 2.5 million customer assistance program applications, approximately 80% of them digitally.

“We have implemented the most ambitious customer relief program in the bank’s history,” says President and CEO Brian J. Porter, “providing fast relief to those who need it most.”

That effort extends beyond the bank’s customer base. In April, it donated a total of C$2.5 million to variously: community response efforts supporting local charities; United Way’s Covid-19 Community Response and Recovery Fund; academic partners working on Covid-related health care innovations; and support future needs of charities as the pandemic continues. In conjunction with the Canadian Medical Association, Scotiabank also gave C$250,000 to the Code Life Ventilator Challenge, which encourages the creation of simple, low-cost ventilators.

Methodology: Behind the Rankings

Selection was limited to entities that submitted entries. After an initial review by a panel of three independent judges, those whose efforts were on par with peers (rather than above the average) were eliminated. The remaining entrants were evaluated, scored in each category and ranked separately by each of the judges as well as two Global Finance editors. Scoring took into consideration local conditions and the capacity of the entrant, and awarded points for speed, innovation and cross-border reach.