Country Report

Jump To Section

Refining The Mix

King Abdullah’s Legacy For Saudi Arabia

Saudi Arabia Throws Open The Doors To Foreign Investors

Saudi Arabia | Banking Sector Report

Saudi Arabia’s budget deficit is ballooning, but a ministerial reshuffle has fueled hopes the kingdom is resolute in kicking its hydrocarbon addiction.

Oil prices have halved since June, but at November’s OPEC meeting Saudi Arabia confronted the threat from US shale by pledging to maintain output levels. It is a major gamble, and the repercussions for the economy are already being felt. In a statement on December 25, the Ministry of Finance forecast a hefty budget deficit in 2015 of 145 billion Saudi riyals ($38.7 billion) on expenditure of 860 billion riyals and revenues of 715 billion riyals.

The death in late January of king Abdullah and the accession of Salman bin Abdulaziz to the throne also complicates matters for the Gulf kingdom—but indcations suggest that he will maintain continuity with the previous administration’s policies.

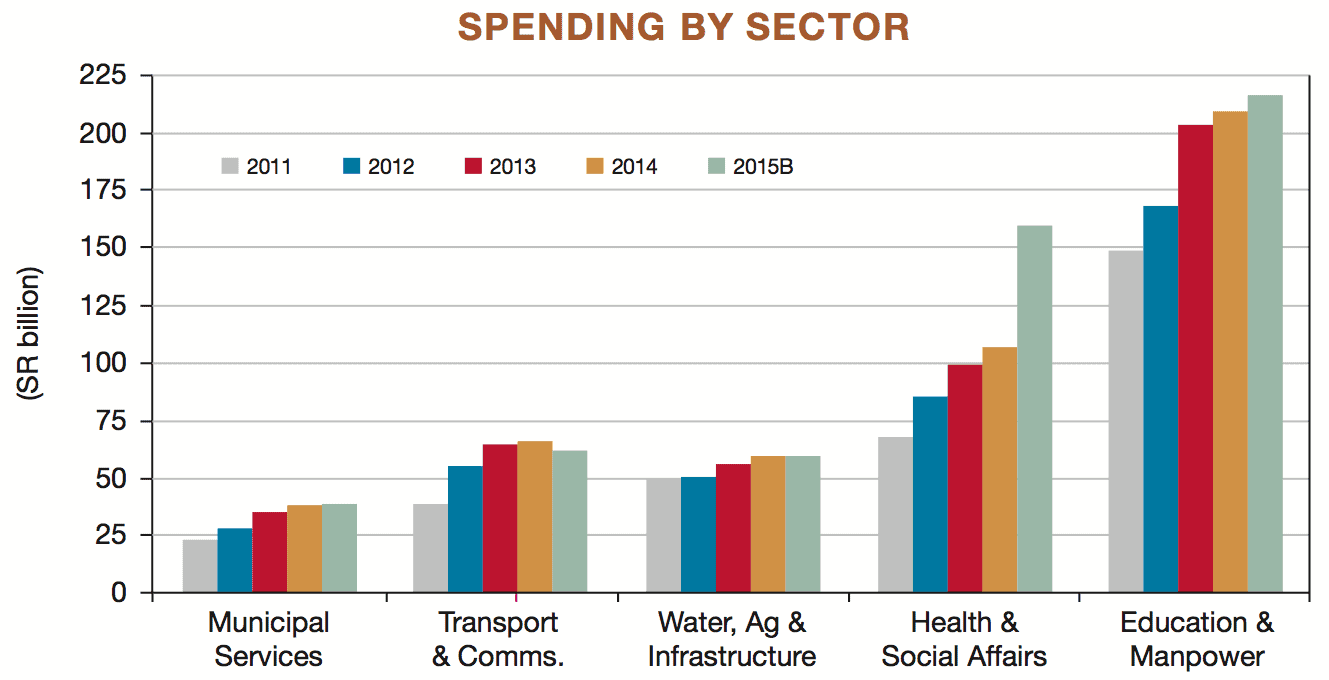

Spending has increased just 0.6% over 2014 but is nevertheless at record absolute levels, and it shows the government’s determination to keep the economy in an expansionary state. The Finance Ministry has revealed, meanwhile, that the 2014 budget swung into a surprise deficit, recording a shortfall of 54 billion riyals. The key spending areas in 2015 will be education, health and social affairs, which are set to receive 43.8% of total expenditure (see chart below).

Of all the countries in the Middle East, Saudi Arabia is the most enigmatic. At the heart of a troubled region, it considers itself leader of the Sunni world and spiritual home of Wahhabism, the puritanical form of Sunni Islam. Saudi Arabia has accumulated vast reserves from oil revenues but is locked in an existential battle with regional nemesis Iran and faces mounting economic pressure. For decades the government has maintained a social contract providing a cradle-to-grave welfare system for its citizens. With succession back on the agenda, modest progress in economic diversification and significant levels of youth unemployment, the kingdom faces multiple challenges.

It remains hugely dependent on oil, which, says Standard & Poor’s, accounts for 90% of government revenues and 45% of GDP. Jadwa Investment analysts believe the deficit may hit 6.1% of GDP, or 167.6 billion riyals, in 2015. Jadwa forecasts real GDP growth in 2015 at a modest 2.5%.

Fahad Alturki, chief economist and head of research at Jadwa Investment in Riyadh, says ordinarily a budget deficit could spark negative sentiment in the private sector, which relies heavily on public spending. Nevertheless, the government has taken a countercyclical stance, effectively propping up the private sector. “Our view is, the budget remains expansionary, with spending maintained at a very high level, which will play a vital role in supporting the economy,” says Alturki. He believes that budget will keep the growth of the non-oil sector above 4% for 20152016. The private sector bore the brunt of cutbacks during previous deficits, when the government delayed payments and slowed the pace of new projects.

OIL: GEOPOLITICAL PLAY

Saudi Arabia’s oil pricing strategy may be geopolitical. According to some analysts, the kingdom has Iran and Russia in its sights, as well as less-efficient shale producers in North America. In 2015, the IMF calculates, Iran has a fiscal break-even price per barrel of oil of $131, against $106 for Saudi Arabia.

Betting against shale is trickier, and despite lower oil prices, many shale producers have hedged prices through derivatives contracts. Even so, after Russia, Saudi Arabia—with approximately 9.7 million barrels per day of production—remains the world’s top exporter. But the decline in US reliance on imported crude appears to have caught it off guard. According to the US Energy Information Administration, US output reached almost 8.9mbpd in September.

Still, Saudi Arabia has deep pockets, and with $740 billion in reserves, according to Capital Economics in London—equivalent to around 100% of GDP—it can run deficits for many years to come. If the kingdom does not want to draw down from its vast savings, it has one of the lowest levels of government debt in the world, estimated by the IMF at just 2.5% of GDP in 2015. The great unanswered question is how low oil prices will go, and for how long? Nevertheless, with the fall in prices the kingdom has been under pressure to moderate spending, with the IMF warning that it is essential to strike a balance.

The kingdom has much less room to maneuver than before the drop in oil prices, according to Jaap Meijer, managing director, equity research, at Arqaam Capital in Dubai. “The room for additional discretionary spending remains very limited, notwithstanding KSA’s vast reserves, in our view. Saudi Arabia’s Finance Ministry will discuss with the central bank options for financing the large budget deficit and may cover some of the shortfall with borrowing.” Meijer says 2015 budget revenues are based on an oil price of $60 per barrel.

If Saudi Arabia were to tap bond markets, it could probably borrow at a low yields. Despite falling oil prices, spreads of dollar-denominated bonds over US Treasuries in other Gulf countries have remained close to record lows. Doing so would fulfill another objective in deepening and developing the kingdom’s financial markets. Capital Economics says Saudi Arabia’s bond markets are underdeveloped, by emerging markets standards, and issuing government debt would add depth as well as complement the planned opening of the stock exchange to foreign investment. Foreign institutional investors eagerly anticipate the opening of the Tadawul stock exchange to direct foreign investment for the first time (see sidebar, page 20).

Nonetheless, there is no escaping the government’s dilemma. It is under pressure to rein in expenditure—to the detriment of the private sector. It could further contain spending by cutting lavish subsidies, notably subsidized gasoline prices, but that threatens to unravel the already fragile social fabric. It could also cut infrastructure spending. Many market watchers have observed that government-backed, multibillion-dollar infrastructure projects have achieved little in productivity gains.

In the wake of the Arab Spring, the government earmarked around $133 billion in infrastructure projects—but they have done little to curb high levels of youth unemployment (a key goal). Saudi Arabia needs a significant step-up in job creation and improvement in the skills and productivity of its young workforce. Salaries, wages and allowances will account for 50% of government expenditure in 2015, a situation the Finance Ministry says it wants to “rationalize.” According to Arijit Nandi, senior vice president, merchant banking, at The National Investor in Abu Dhabi, it is a risky proposition. “That could stir resentment among the kingdom’s youth, who make up a majority of the population and are increasingly struggling to find affordable housing and salaries that cover the cost of living.”

Saudi Arabia’s ability to defuse events that threaten stability has been enabled by a capacity to spend its way out of trouble—whether it increased defense spending or placated domestic unease with generous handouts. For the first time in recent memory that stratagem is under pressure, and with numerous vested interests competing with a rapidly deteriorating regional security situation and a new king on the throne, the outlook for the kingdom’s future is unclear. Much depends, of course, on oil prices, but anyone who can predict the bottom of that commodity cycle might find a warm reception from policymakers in Riyadh.

~ Mark Townsend

Jump To Section

Refining The Mix

King Abdullah’s Legacy For Saudi Arabia

Saudi Arabia Throws Open The Doors To Foreign Investors

Saudi Arabia | Banking Sector Report

King Abdullah’s Legacy For Saudi Arabia

Continuity, stability, order. King Abdullah would have been proud that these are the things most of his countrymen—indeed much of the world—will remember him for. And he would be relieved that they also marked the hours and days that followed his passing, from pneumonia, on January 22. His anointed successor and half-brother Crown Prince Salman immediately took command (although he has been pulling the levers of power for some time now, as Abdullah’s health deteriorated) and indicated there would be no major changes in policy, personnel (with senior figures such as oil minister Ali Al-Naimi kept in situ) or in Saudi Arabia’s geopolitical stance. To the relief of many, 78-year-old Salman immediately appointed another half-brother, 69-year-old Prince Muqrin, as crown prince and Prince Mohammed bin Nayef as deputy crown prince, thus guaranteeing the succession and easing fears about ongoing rivalry.

So what can observers expect in the coming months? Not much change, is probably the answer, coupled with some continued, modest liberalization—for example, in the status of women and in human rights—but nothing that would unbalance the strict Wahabbist interpretation of Sunni Islam that provides the ruling House of Saud with much if its legitimacy. Besides, in a region racked by violence and uncertainty, stability has served Saudi Arabia well and is appreciated by most of its people.

~ Justin Keay

Jump To Section

Refining The Mix

King Abdullah’s Legacy For Saudi Arabia

Saudi Arabia Throws Open The Doors To Foreign Investors

Saudi Arabia | Banking Sector Report

Refining The Mix

King Abdullah’s Legacy For Saudi Arabia

Saudi Arabia Throws Open The Doors To Foreign Investors

Saudi Arabia | Banking Sector Report

Saudi Arabia Throws Open The Doors To Foreign Investors

Last July the Capital Markets Authority (CMA) of Saudi Arabia published a set of draft rules for consultation for a new investment category it referred to as Qualified Foreign Financial Institution (QFI). In what many consider a bold move, it follows a decision by the kingdom’s council of ministers to establish regulations that would allow direct investment by foreigners for the first time on the Tadawul, the kingdom’s $530 billion stock exchange. Until the ruling came into effect, foreign investors outside of the region were restricted to indirect exposure through back-to-back swap arrangements and mutual funds.

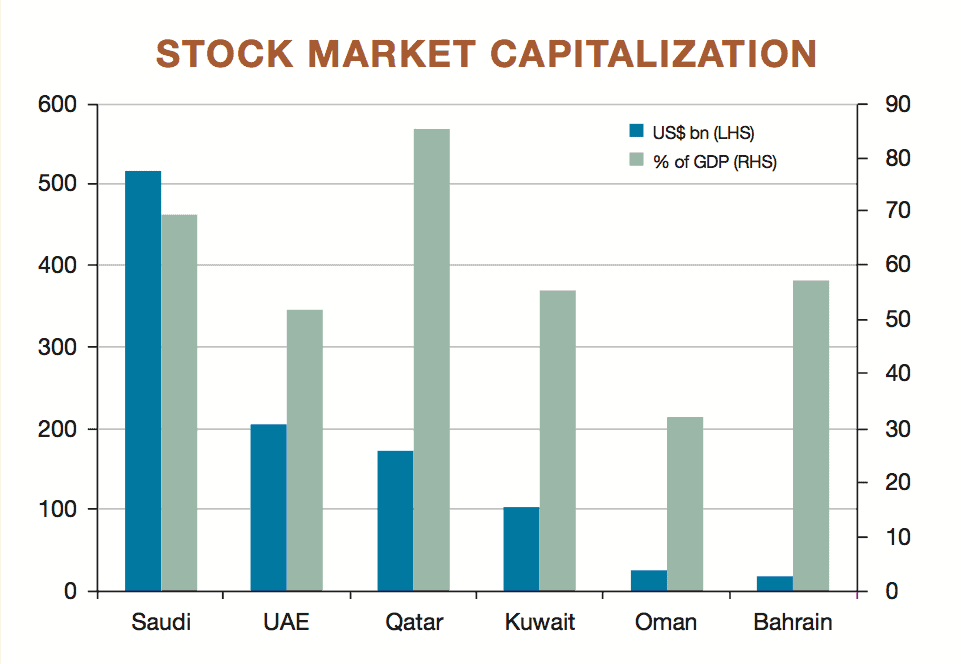

Institutional investors expect to be able to invest directly in the first half of 2015, and many are excited by the prospect. Simply put, the Tadawul dwarfs all other stock markets in the Gulf. Its capitalization is bigger than that of all of the Gulf exchanges put together and is larger than Mexico’s and equal to South Africa’s (see chart).

Even so, the CMA’s draft rules are daunting for foreign investors and will exclude all but the largest. QFIs can hold no more than 5% of the shares of any company traded on the Tadawul. Additionally, QFIs in aggregate may not hold more than 20%, and foreign investors may not hold in aggregate more than 49% of the shares of any company traded on the Tadawul. Non-Saudi ownership of all shares listed on the Tadawul is limited to 10% of overall market value.

A potential QFI must also have total assets under management of not less than

18.75 billion Saudi riyals ($5 billion). The far-reaching nature of the rules that have led some analysts to draw attention to the kingdom’s cautious approach. Amgad Husein, partner at the Wael A. Alissa law firm, in association with Dentons in Riyadh, says ownership limits may lead to an unpredictable experience for QFIs. “It remains to be seen how this will be implemented as a matter of practice. Since there are certain restrictions limiting foreign ownership in the aggregate, QFIs will have to implement their best efforts to carry out investigations in good faith to make sure that they are not violating limits each time they purchase listed shares.”

Some industrial sectors, such as mining and media, and the two holy cities of Mecca and Medina, may be off limits to foreign investors. Despite the complexity, investment firm Jadwa’s Fahad Alturki believes that both investors and policymakers in Saudi Arabia will want to press ahead. “With such good performance of the non-oil sector despite low oil prices and weak global recovery, I do not think there is any plan to adjust the timeline for opening up of the Tadawul.” Nevertheless, investor sentiment may be tempered as equities listed on the Tadawul look expensive with respect to comparable markets. Until recently, the Tadawul was trading at more than 20 times forward earnings—well above its long-term average and at a premium to the MENA region. Indeed, valuations attached to Saudi firms are more on par with developed-world market aggregates such as MSCI World.

~ Mark Townsend