Bank safety has never mattered more than it does now.

The Covid-19 pandemic has exacted an immeasurable human toll—and the accompanying economic crisis continues to unfold. The global banking sector faces deteriorating asset quality in its loan portfolios as industries—including airlines, retail, hotels, travel and leisure, commercial real estate and energy—absorb body blows from the economic collapse; many smaller businesses close permanently; and consumers struggle to pay their bills.

Such is the backdrop for Global Finance’s 29th annual ranking of the World’s Safest Banks, which honors institutions that stand out for strength and resilience. Surprisingly, our rankings involving the largest banks do not reveal significant shifts.

Following the outbreak of the pandemic, many banks responded quickly: prioritizing the safety of their employees and customers by retrofitting workplaces, encouraging remote work arrangements and closing some branches. Institutions also adopted an accommodative approach with their retail and corporate customers: extending more-flexible terms on loan payment, lowering interest rates and providing relief from fees and service charges.

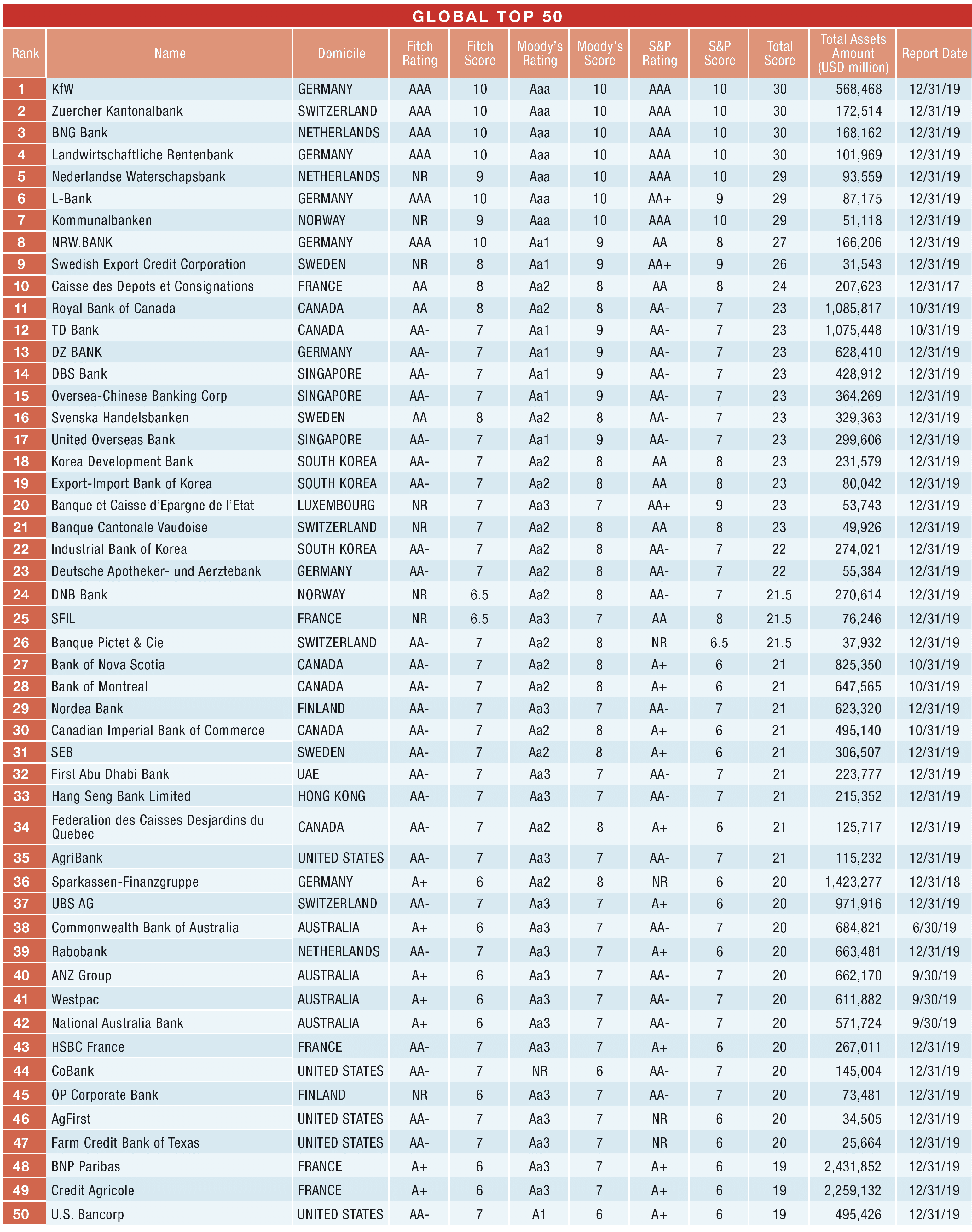

The World’s Safest Banks 2020 |

|---|

As expected, the rating agencies reassessed the global banking sector as a whole and major banks, and shifted its outlook on many institutions to Negative, (a longer-term view of 1 to 2 years) and in some cases to Negative Watch / Review (a near-term view of 1 to 2 quarters) reflecting an immediate rating risk. According to Fitch, the proportion of global banks with a negative outlook or on Negative Watch rose to over 60% as of June 2020 from 13% at the end of 2019. Still, the larger banks in our rankings have been better able than smaller competitors to avoid rating agency downgrades.

Banks in Emerging Markets (EM) have not fared as well. Of the 109 downgrades by Fitch in the first half of this year, 87% were in emerging markets. Not all was due to their own deteriorating credit profiles. Many EM banks derive uplift from sovereign support, and a number of sovereign downgrades contributed to the slide of individual banks—particularly among the Safest By Country.

Learning from the Last Crisis

Yet overall, the sector has shown surprising resilience so far. Due in large part to post-2008 crisis regulatory measures, banks went into this crisis with stronger capitalization, funding, and liquidity positions. Their loss-absorbing capacity and ability to assess and manage risk has improved dramatically, and the impact of the pandemic may be more of a profitability hit rather than an erosion in capital, thereby preserving their ratings. This is particularly the case with the banks in the Global Top 50.

Central banks have responded with stimulus programs and relief measures to provide liquidity and alleviate stress. These include new asset purchase programs, liquidity and credit facilities, debt guarantees and trillions in direct stimulus to individuals and businesses.

Additionally, regulators have eased capital requirements and liquidity buffers to provide greater financial flexibility. Notably, the Basel Committee on Banking Supervision has deferred its required implementation of the Basel III regulatory framework on bank capital adequacy standards by one year, to January 2023.

Some jurisdictions are requiring a more comprehensive assessment of bank capitalization to better gauge the impact of the Covid-19 crisis. While the release in June of the US Federal Reserve’s Dodd-Frank Act Stress Test (Dfast) results indicated that banks’ capital and leverage ratios exceeded the minimum under a severely adverse stress scenario, the Fed decided to require a second round of Dfast. In the meantime, the Fed reiterated its requirement that banks preserve capital by suspending share repurchases and capping dividend payments. The second Dfast test will incorporate a new set of benchmarks for 22 US-based banking groups and the US operations of 11 non-US banks, including more-stringent assumptions regarding GDP growth and unemployment.

Standard & Poor’s expects a modest capital impact for top-rated banks, with risk-adjusted capital ratios falling from a 2019 average of 9% to 8.7% during 2020 and stabilizing in 2021.

The Top Global 50

Global Finance’s annual ranking of the World’s Safest Banks employs a proprietary methodology that incorporates long-term foreign currency debt ratings by Fitch, Moody’s and Standard & Poor’s (See Methodology box). As always, year-over-year ratings fluctuations reshuffle the rankings.

L-Bank is no longer triple-A rated by all agencies as S&P downgraded the German bank to AA+ in August following a downgrade of its domicile jurisdiction, the state of Baden-Württemberg, to AA+. L-Bank falls one spot to 6th place in this year’s global ranking, with Nederlandse Waterschapsbank taking its place at 5th.

Luxembourg-based Banque et Caisse d’Epargne de l’Etat falls to 20th place, reflecting the application of our methodology. Deutsche Apotheker- und Arztebank fell two spots due to an August downgrade by Moody’s to Aa2 from Aa1. In April, Fitch downgraded the four Australian banks represented in the Global Top 50 to A+ from AA-, knocking them down in our rankings by at least eight positions each.

Other notable fallen angels include Swedbank, downgraded by all three agencies; and National Bank of Kuwait, which S&P demoted to A from A+ in March. That made way for Credit Agricole, which Moody’s upgraded to Aa3 from A1; and US Bancorp, which entered the global ranking for the first time in 49th and 50th place, respectively.

As in prior years, but especially given the additional stress of the Covid-19 crisis, some additional rating agency actions followed the September 4th finalization of the rankings. Most were affirmations with negative outlooks maintained. For example, Fitch affirmed the four Australian banks included in our Global Top 50 but downgraded Rabobank to A+ from AA- with a negative outlook. Some actions were the result of a downgrade of the sovereign, for example, Moody’s downgrade of Kuwait and Turkish banks.

Overall, Fitch takes the view that near-term risks have abated. Only 4.8% banks on Ratings Watch Negative ended up being downgraded; most reverted to a Negative Outlook that will remain for a while. Loan support programs and other mechanisms have delayed the recognition of credit costs. but will expire. Downgrades may have been avoided for now, but considerable risks remain.

Methodology: Behind the Rankings

Our rankings apply to the world’s largest 500 banks by asset size, and are calculated based on long-term foreign currency ratings issued by Fitch Ratings, Standard & Poor’s and Moody’s Investors Service. Where possible, ratings on holding companies rather than operating companies were used; and banks that are wholly owned by other banks were omitted. Within each rank set, banks are organized according to asset size based on data for the most recent annual reporting period provided by Fitch Solutions and Moody’s. Ratings are reproduced with permission from the three rating agencies, with all rights reserved. A ranking is not a recommendation to purchase, sell or hold a security; and it does not comment on market price or suitability for a particular investor. All ratings in the tables were valid as of September 4, 2020.