With asset prices low while fundamentals are improving, Latin American economies are poised for a rebound.

As Brazil and Argentina are slowly recovering from the 2016 recession, Latin America and the Caribbean are expected to do much better in 2017 than last year. The International Monetary Fund predicts average GDP growth of 1.2% versus a contraction of 0.7% in 2016.

From one country to another, however, stark differences remain. Mexico, which expanded last year, is likely to slow down; while two countries with the highest forecast growth—Peru and Colombia—are at risk of corruption scandals and contracting government spending. The larger cloud over the whole region is what the new US administration led by Donald Trump will do in term of policies on trade.

For the time being, the improved economic outlook combined with the sharp fall in asset prices of the recent past is bringing back the attention of foreign investors on the hunt for sales in Brazil and in neighboring countries.

“Latin America is the region we like the most among all emerging markets,” says Jan Dehn, global head of research at investment manager Ashmore. “There is more value in assets in Latin America than in other regions around the world. Latin America was beaten up more than other regions over the past few years. However, asset prices declined far more than fundamentals—which are now improving—so there is considerable upside for investors.”

Dehn favors Brazil in particular. “Brazil will experience what I call ‘super-Goldilocks’ [conditions]. Goldilocks is when growth picks up and inflation falls at the same time. But in Brazil, you will additionally have rate cuts and currency appreciation. This makes a very compelling environment for strong fixed-income and equity market performances.”

Brazil saw a contraction of around 3.5% in 2016 and is expected to see mild growth this year. “It is reasonable to say that we will grow minus 0.2% or plus

0.2% but it does not make a large difference: we expect stagnation,” says José Francisco de Lima Gonçalves at Brazilian Banco Fator, who also sees good deals for equity investors. “I see opportunities in iron and steel, thanks to demand from the United States and China; in gas and oil for a recovery in Petrobras; and in financials for the decline in interest rates.” Bank stocks have already started to climb, he notes, due to lower interest rates.

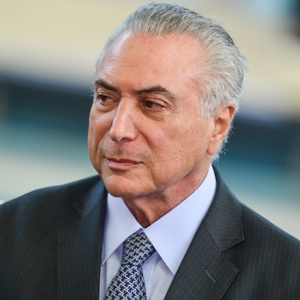

In Brazil, the 2018 presidential campaign stamps a big question mark on the future. The government led by Michel Temer is making progress with its fiscal reform proposals, but pension and labor reforms are still under discussion. “Temer has a very strong support base in Congress, but he is also battling with a very low level of popularity and political volatility in relation to major corruption investigations; so it is not a given that he will be able to pass two main structural reforms,” says Jimena Blanco, head of Americas at global strategy consultant Verisk Maplecroft. “I do expect some reforms in [labor and pensions] this year but maybe not as ambitious as Temer would want them to be.”

HOPES IN PRO-BUSINESS LEADERSHIP

A new wave of more promarket, reform-oriented governments are raising hopes that Latin America could enact reforms that would lead to outperforming other emerging economies. “We have seen a very significant shift in the quality of governance, not just in Brazil but across large swathes of Latin America,” says Dehn. “We have now a better president in Peru and a better president in Argentina; and in the last major bastion of populism, Venezuela, President Nicolás Maduro looks very, very weak. Sebastián Piñera looks likely to replace Michelle Bachelet in the next Chilean election, and Ecuador may also see a more market-friendly government soon.”

Argentina was plagued by a recession that curtailed its GDP by around 2.4% in 2016; but the downturn appears to have bottomed out, and the country might offer one of the best recovery stories—the IMF expects GDP expansion of 2.2% this year. Midterm elections on October 22 will be a key test of support for president Mauricio Macri. “Performing well in the midterm election is a good advance indication of reelection in 2019 of a second Macri administration, which will enable him to submit a deeper reform agenda. If he loses the election we are in front of a very uncertain-looking period, because he could be seen as a president who is not going to last more than one term—and this could lead the opposition to be a lot more obstructionist in congress,” says Maplecroft’s Blanco. “[But] Macri has shown in the past two years that he is an extremely technical negotiator, [so] I would not be surprised to see very gradual progress this year in terms of further probusiness reform.”

Peru’s GDP should expand a healthy 4.3% in 2017. But a series of bribery scandals linked to Brazilian builder Odebrecht are sweeping the country and its former political leaders. Current president Pedro Pablo Kuczynski has tried to distance himself from the corruption of the former administration, supporting the arrest of former president Alejandro Toledo; but the risk is that policymaking will be paralyzed by the scandals. “Potentially, investigating Kuczynski could turn into a major congressional priority over the next couple of years and force everything else out,” says Katie Micklethwaite, senior analyst at Verisk Maplecroft. “I think that is a big risk.”

Aside from self-inflicted uncertainties, the region also faces risk from changes in US trade policies under president Trump. The unilateral withdrawal from the Trans-Pacific Partnership, which includes Chile, Mexico and Peru, put a new wrinkle in international relations. It seems too soon to say what direction these policies will take and to evaluate their impact on the region.