From Cape Town to Cairo, digital banking is the buzzword as incumbents and newcomers vie for a young, tech-savvy population.

Digital financial-service platforms are expanding in Africa. From branchless banking and digital wallets to transacting over mobile gadgets, banks are transforming how customers use their services, riding the continent’s rapidly growing youthful and tech-savvy population. Bankers, financial analysts and other experts say there is every reason to be bullish about the industry.

In the drive toward digital banking, “Africa is benefiting from an unexpected advantage: its historically modest telco infrastructure,” says Jason Blick, CEO of EQIBank, a global digital-only bank for corporate and private clients. “It’s a perfect storm of opportunity for forward-thinking digital banks, many of whom see Africa as the world’s No. 2 banking market in terms of growth and profitability. Africa gives us the opportunity to help address some of the continent’s historic economic challenges while also driving expansion in our digital-banking products and services.”

The growing uptake of digital platforms across the industry is multipronged, attracting not only digital start-ups but incumbent banks looking to enter new segments.

These include the nearly 75-year-old WEMA Bank in Nigeria, which in 2018 launched the country’s first fully digital bank, providing branchless customer service. Ecobank has been a front-runner with the successful rollout of its digital banking platform, Xpress, which it says has attracted 3 million customers across Africa in just six months.

Standard Chartered Bank is another institution seeking to embrace disruption through digital transformation. It launched its first purely digital bank in 2018 in Côte d’Ivoire, says Jaydeep Gupta, head of Retail Banking in Africa and Middle East. A further multimarket rollout of digital-only banking for its markets in Africa has been completed this year, covering countries such as Uganda, Tanzania, Ghana, Kenya, Botswana, Zambia and Zimbabwe—with more to come.

“We will launch the digital bank in Nigeria” before year-end, says Gupta, “and we are keen to maintain our momentum and expand across the region with the digital-bank solution where it is needed most.”

Standard Chartered’s mobile application gives customers access to a host of banking services without having to visit a physical branch. “Demand for digital banking services is coming directly from consumers,” says Gupta, “particularly in sub-Saharan Africa, because of a high mobile penetration and a digitally savvy, young population” hungry for purely digital experiences across sectors.

Other digital models emerging in Africa encompass start-ups, fintechs and telcos looking to enter banking, strategy company McKinsey notes. These include Bank Zero and Tyme Bank in South Africa. Tyme, controlled by Patrick Motsepe’s African Rainbow Capital, became the first purely digital bank in South Africa after rolling out branchless operations in August. It operates online and mobile platforms as well as kiosks inside retail outlets such as Pick n Pay supermarkets and Boxer stores, which offer a physical presence for customers. Customers can open an account through any South African mobile network, with simple requirements such as an ID number and mobile-network number that prompt a few additional questions and confirmations.

Across these digital-banking models, McKinsey says the major business driver is a strategy to reduce costs through end-to-end automation and doing away with branches. McKinsey also points to “increased cross-sell through advanced analytics to identify relevant offerings for customers that they can purchase directly on digital channels” as a major business driver.

Banking on Youth

Chijioke Dozie, CEO and co-founder of Carbon, a Lagos-based financial-services company, says Nigeria, South Africa and Kenya offer significant opportunities for digital banking, especially among the younger crowd.

“Many people under 30 have largely been underserved by the traditional banking system,” he says. “For many of these consumers, financial inclusion is about having access to the necessary advisory and business management services to enable their businesses to thrive and expand anywhere. Africa is a mobile-first market—and in some cases mobile-only—and most people are used to accessing a wide range of services primarily via their mobile phones. Adding banking to this range of services will not be too much of a challenge.”

In addition to widespread smartphone adoption, sub-Saharan Africa is a major market for mobile money. The region saw a 14% annual increase of registered mobile wallets in 2018 to 396 million, according to trade group GSMA. Telecom companies are taking the cue to roll out digital-banking services in markets such as Zimbabwe, Tanzania, Kenya and Nigeria, either in partnership with banks or as part of mobile-money services linked to banks and accessible through mobile phones.

Over 40% of African banking users prefer digital channels for their financial needs, McKinsey says in recent report. At Standard Chartered, the preference is even stronger. Almost all (96%) of its digitally acquired customers “prefer to transact outside the physical branch network.” That trend is evident among Standard Chartered’s elite customers, as well. “Today, half of our Priority Banking clients use our digital channels, and close to 40% of our Private Banking clients use their mobiles to manage their banking needs,” Gupta says. “We fully expect these numbers to grow as we continue to introduce new features to bring greater ease and convenience for our clients. Additionally, our digital banks in Africa are serving over 85,000 new registered users.”

In Zimbabwe, mobile-money platform EcoCash now offers a service that converts diaspora remittances—completed through money-transfer partners such as Western Union—into local currency. EcoCash has leaned heavily on its sister bank, Steward Bank, both now weaned off mobile telco Econet Wireless. EcoCash also provides access to cross-digital financial services such as payments, transfers and microloans with Steward Bank and other linked banks.

Despite some early success with digital-only banking platforms, McKinsey cautions that some countries are more receptive than others to the transformation. In North Africa, for example, countries with a well-established banking infrastructure, such as Morocco and Tunisia, might not be as hungry for branchless services as countries with low banking penetration, such as Egypt.

Creating the Right Environment

Better, more-consistent regulation breeds confidence in any financial innovation. The World Bank reports that governments in sub-Saharan Africa have started to develop regulatory responses to the fast-paced developments in digital banking and financial services—although it cautions that much work remains. This includes adjusting existing legal and regulatory frameworks to accommodate challenges relating to competition, Anti-Money Laundering/Combating the Financing of Terrorism measures (AML/CFT), cybersecurity, consumer protection and data privacy issues.

“In addition to creating an enabling legal and regulatory environment, many developing economies, including in the Africa region, can play an active role in facilitating digital financial services by supporting the development of critical financial infrastructure that would support the interoperability of payment instruments or integration of digital data into credit reporting systems,” says a World Bank spokesperson.

Despite some limitations—such as high data costs, finding skilled technologists to help deploy the platforms and regulatory holdbacks—digital banks will inject much-needed competition into African banking, which should help reduce fees, says Joanne Kumire, market research analyst at fintech consultancy 11:FS.

“The African population, particularly the younger demographic, is digitally savvy and has shown a strong preference for mobile and online banking. Furthermore, the population as a whole is migrating toward digital banking, primarily because of the lack of other options at times,” says Kumire.

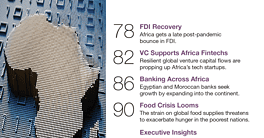

The key to unlocking the potential for digital banks in Africa lies in tailoring solutions and platforms to the local markets and their particular features—including, in some cases, frequent power outages. That said, the rapid adoption of these services thus far suggests that the industry has a strong reserve of optimism to carry it forward.