Executive Interviews

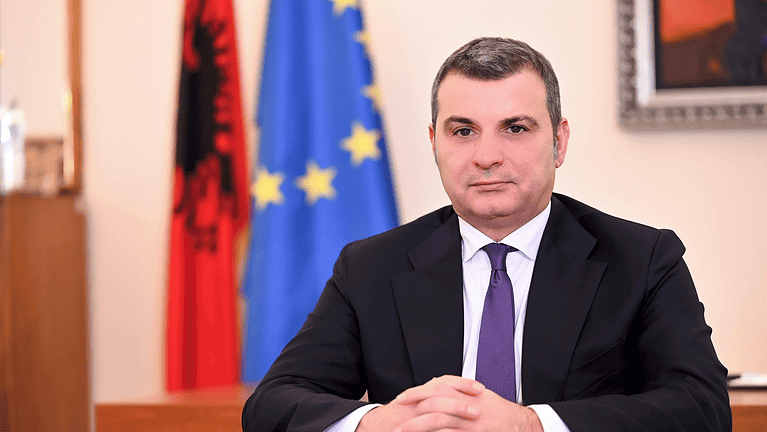

Gent Sejko: Managing Growth

Gent Sejko, governor of the Bank of Albania, discusses the country’s economic transformation.

Global news and insight for corporate financial professionals

Join the global community of corporate and public-sector finance industry leaders reading Global Finance monthly in print.

Click Here

Executive Interviews

Economics, Policy & Regulation

Data

Economics, Policy & Regulation

Awards

Economics, Policy & Regulation

Capital Raising & Corporate Finance

Capital Raising & Corporate Finance

Award Winners

Award Winners

Award Winners